The Price Of Patience

Filed in: Investment |Economy

21 November 2024

Understanding the Price-to-Earnings (P/E) Ratio and Market Returns

Key Points Summary

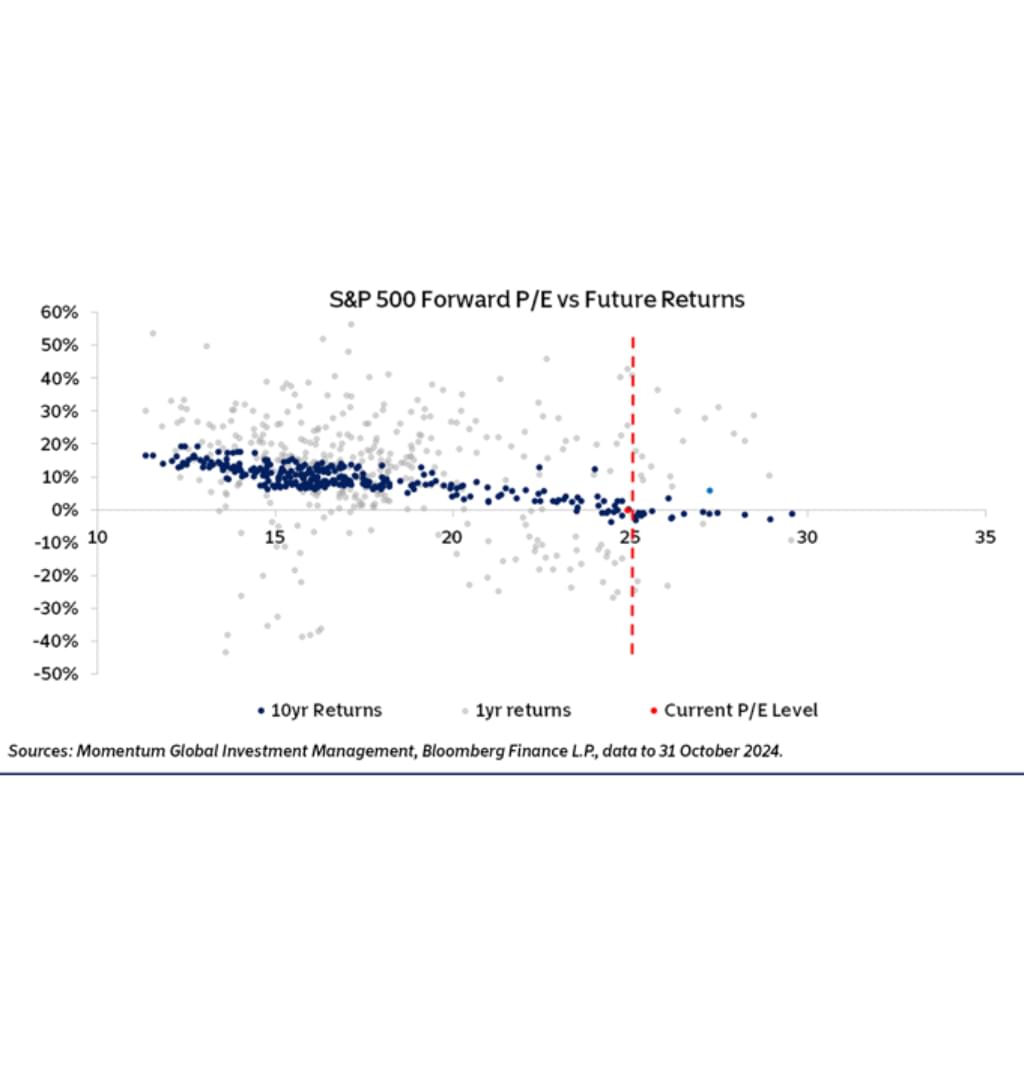

- Short-Term vs Long-Term Returns: Short-term returns (1 year) show no clear pattern with P/E ratios Long-term returns (10 years) show a strong correlation: lower P/E ratios typically lead to better returns

- Current Market Valuation: The market's P/E ratio is currently above 25 This high valuation historically suggests lower returns over the next decade This indicates we're in a relatively expensive market

- Investment Implications: Valuation matters most for long-term investing Investors should set realistic expectations given current high valuations Focus on finding value opportunities and maintaining a disciplined, long-term approach.

What Is A P/E Ratio?

Short-Term Results (1 Year) - Red Line

The red dots show one-year returns

These are scattered all over the place in the actual data but the trend line is shown here.

Key Point: The P/E ratio doesn't really help predict how stocks will perform in the next year

Long-Term Results (10 Years) - Dark Blue Line

The blue dots show ten-year returns

There's a clear pattern: lower P/E = better returns

Think of it like buying a house: paying a reasonable price usually leads to better long-term value

Current Situation

The market's P/E ratio is currently above 25 (shown by the dashed light blue line)

This is considered quite expensive historically

Based on past patterns, this high P/E suggests returns over the next decade might be lower than historical averages

Why This Matters for New Investors

Time Horizon is Key

If you're investing for the short term (1 year), the P/E ratio isn't very helpful

If you're investing for the long term (10+ years), paying attention to P/E ratios becomes much more important

Investment Strategy Implications

Consider spreading out your investments over time (dollar-cost averaging) Timing The Market Vs Time In The Market outlines this rationale.

Look for opportunities in markets or sectors with lower P/E ratios

Set realistic expectations: high P/E markets typically mean lower future returns

Don't try to time the market for short-term gains

Additional Context

High P/E ratios don't mean you should avoid investing altogether

Consider diversifying across different markets and investment types

Remember that while P/E ratios are important, they're just one of many factors to consider

The main takeaway: While today's high P/E ratio suggests caution, successful investing is about taking a long-term view and staying disciplined with your investment strategy, regardless of market conditions.

A discretionary fund manager is ideally placed to help navigate these issues on your behalf.