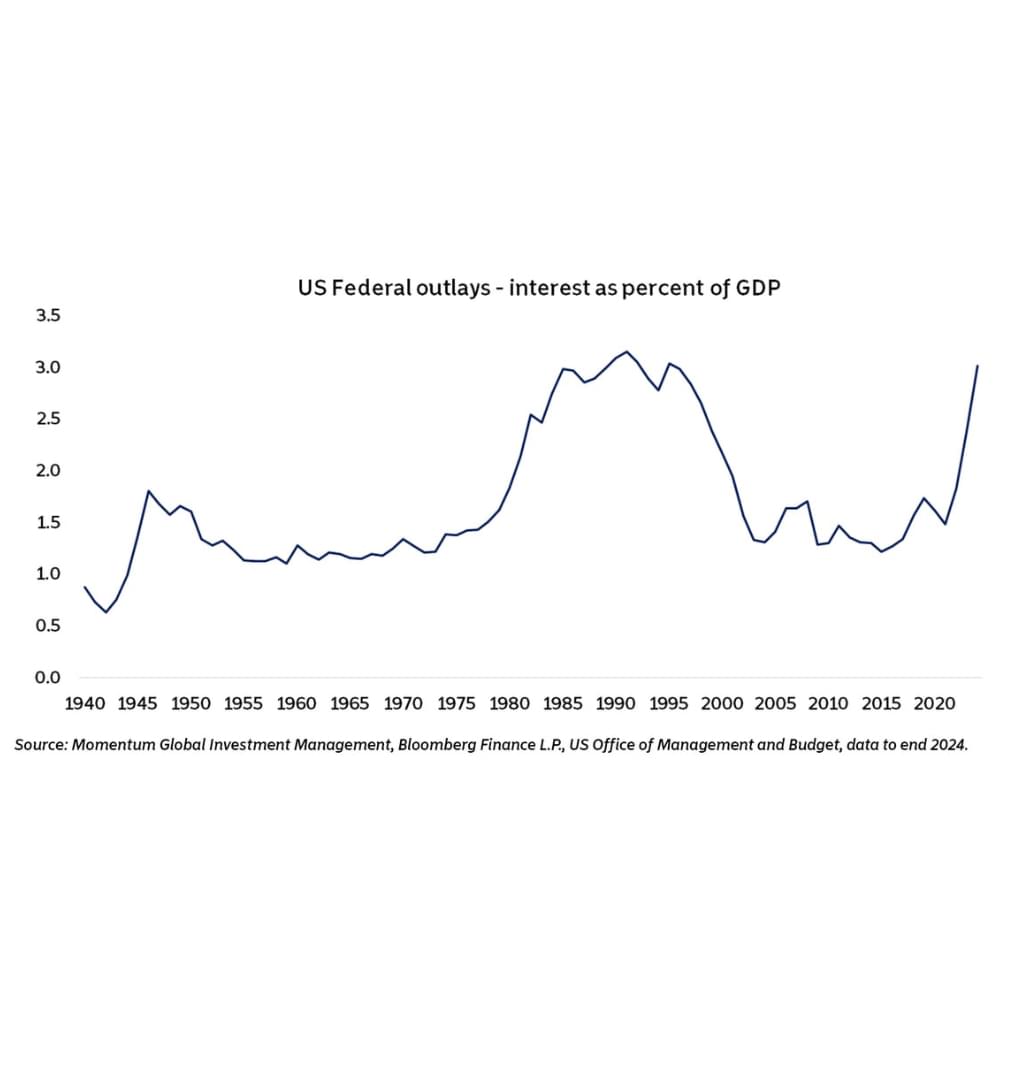

Rising Tide Of US Interest Payments

Filed in: Economy |Investment

03 June 2025

For the first time in 100 years, America spends more servicing its debt than defending itself.

An 85-year analysis reveals US federal interest payments heading toward 4% of GDP by 2035 the highest in American history.

With debt service now exceeding defence spending for the first time in a century, historical patterns warn of serious implications for America's fiscal future and global power.