Active Investment Management Comeback

Filed in: Investment

22 July 2025

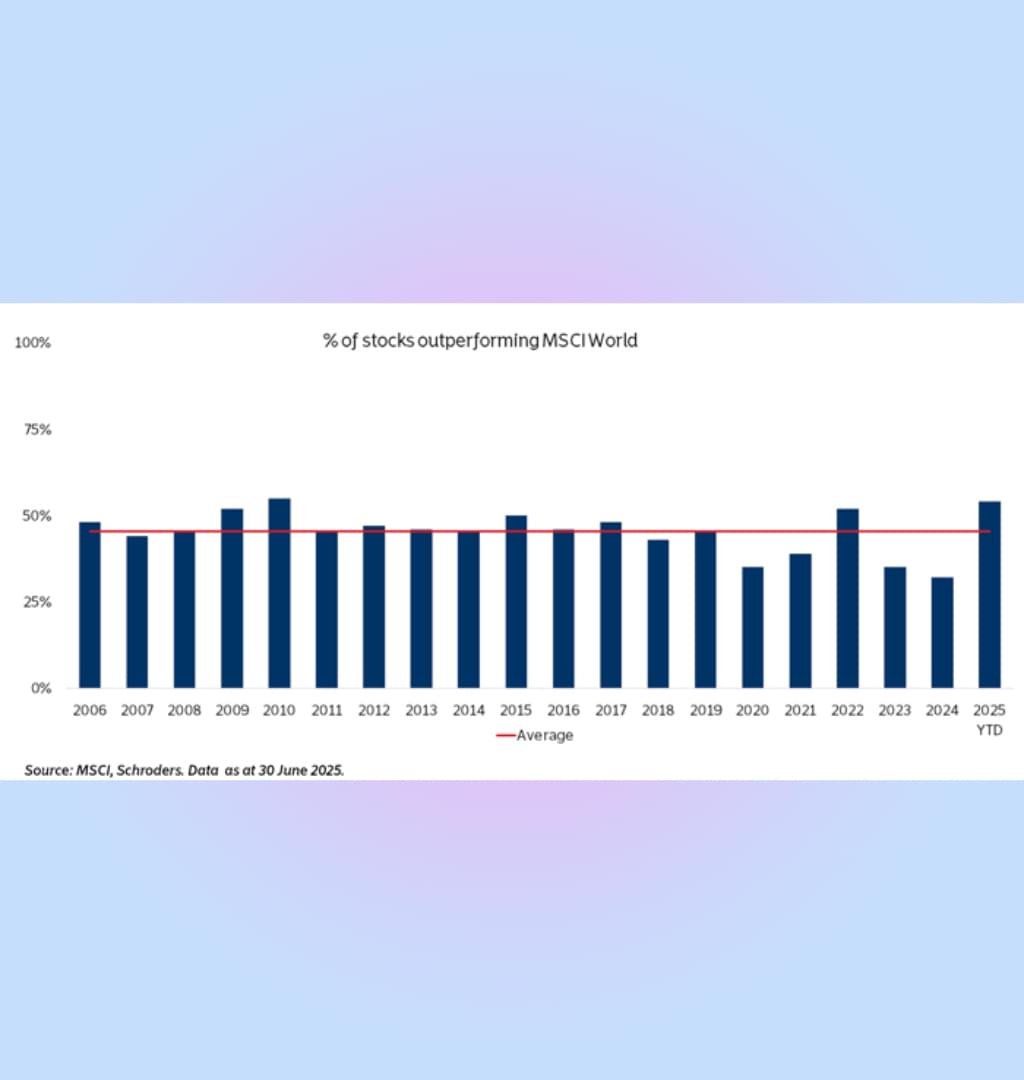

After years of struggling against concentrated mega-cap dominance, active fund managers are finally seeing the market breadth they need to outperform.

With over 50% of stocks now beating the MSCI World, up from just 30-35% in recent years, 2025 may mark the long-awaited comeback of skilled stock selection and professional portfolio management.