Timing The Market Vs Time In The Market

Filed in: Momentum |Investment |Pensions |Savings |TAM

15 April 2025

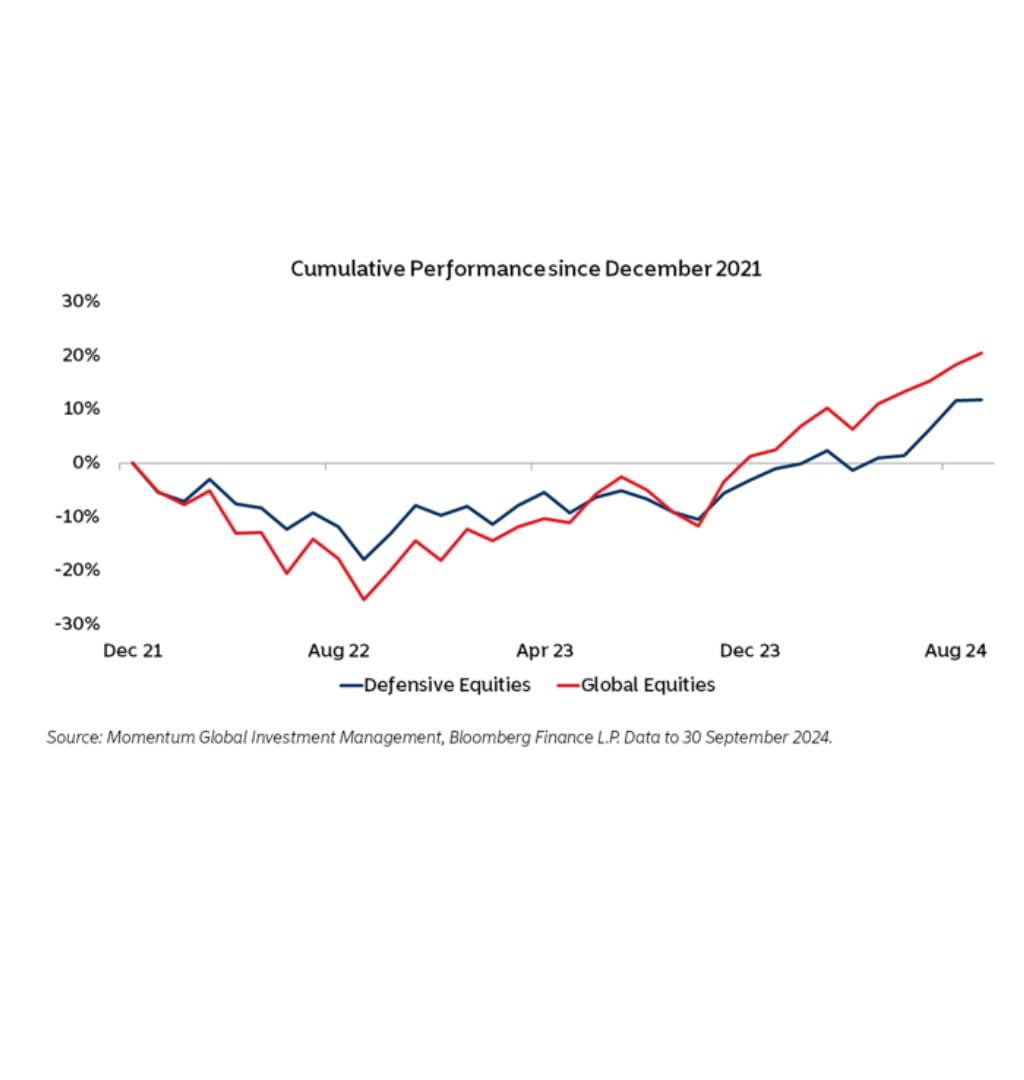

The relentless pursuit of perfect market timing has left countless investors with diminished returns and heightened anxiety, while history repeatedly demonstrates that patient, long-term market participation typically yields superior results.

Examining decades of market data reveals a compelling truth: the investor's greatest allies are not sophisticated timing techniques but rather disciplined consistency and the remarkable power of compound growth over time.