Timing The Market Vs Time In The Market

Filed in: Momentum |Investment |Pensions |Savings |TAM

15 April 2025

Patience is a virtue

Key Points Summary

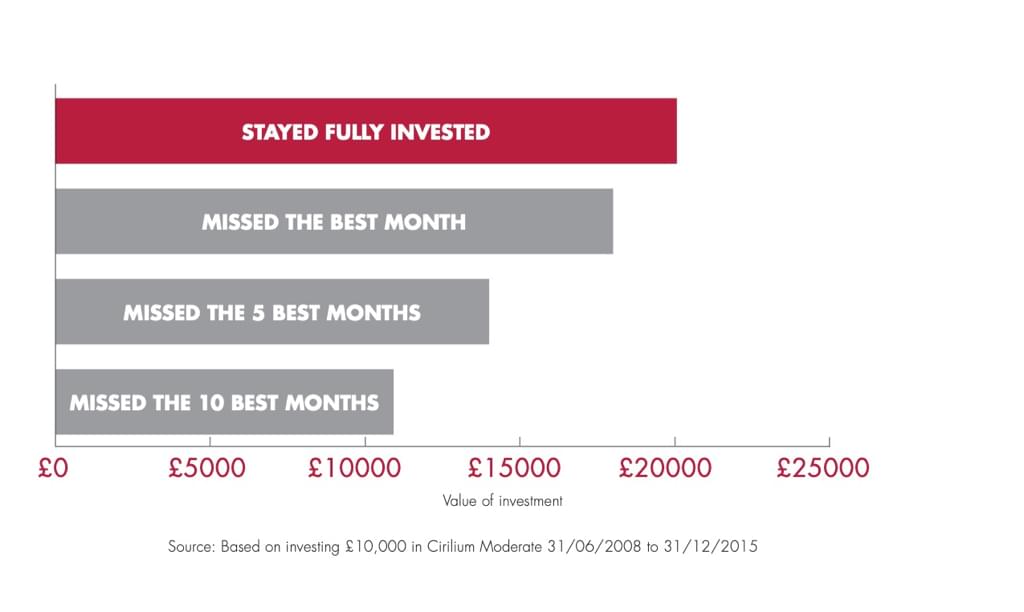

- Missing the Best Days is Costly: Historical data consistently shows that missing just a handful of the market's best-performing days can dramatically reduce overall returns, with studies indicating that missing the 10 best market days over a 20-year period can cut potential returns by more than half.

- Market Recoveries Are Often Swift and Unexpected: Major market downturns are typically followed by rapid recoveries that catch many timing-focused investors off-guard, as exemplified by the 2009 financial crisis recovery and the remarkable five-month rebound following the March 2020 COVID-19 crash.

- Psychological Biases Undermine Timing Efforts: Human cognitive tendencies like loss aversion, recency bias, and herd behaviour make consistent market timing success nearly impossible, leading average investors to significantly underperform market indexes primarily due to poorly timed buy and sell decisions.

- Time Horizon Dramatically Improves Success Rates: While daily market movements are essentially a coin flip, the probability of positive returns increases significantly with longer time horizons--from 74% for one-year periods to 87% for five-year periods and a perfect 100% success rate for all 20-year investment periods since 1926.

Timing the Market vs. Time in the Market: Why Patience Pays Off

In the realm of investment strategies, few debates are as enduring as "timing the market" versus "time in the market."

While the allure of perfectly timing market entries and exits tempts many investors, historical evidence overwhelmingly supports a patient, long-term approach to wealth building.

This article examines why attempting to predict market movements often proves costly, while maintaining steady market exposure typically rewards investors with superior returns.

The Costly Pursuit of Perfect Timing

Market timing is the practice of moving in and out of the market or switching between asset classes based on predictive methods. The strategy seems logical: buy low, sell high, and avoid the downturns. However, markets have proven repeatedly that they are inherently unpredictable in the short term.

The High Cost of Missing the Best Days

Market gains are often concentrated in brief, unpredictable periods. Research consistently shows that missing just a handful of the market's best days can dramatically impair long-term returns.

A study by J.P. Morgan Asset Management analysed the S&P 500 returns from January 1, 2000, to December 31, 2019. Their findings were striking: if an investor remained fully invested during this period, a $10,000 initial investment would have grown to $32,421. However, if they missed just the 10 best market days during those two decades, the same investment would have yielded only $16,180--roughly half the returns.

Even more sobering, missing the 30 best days would have resulted in a value of just $9,315, representing a loss on the initial investment despite the overall market gaining over 6% annually during this period.

Market Rebounds: Why Exits Can Be Expensive

One of the most compelling arguments against market timing is the speed at which markets can recover following major downturns. Historical evidence shows that rebounds often occur suddenly and powerfully, catching many sidelined investors off guard.

Historical Market Recoveries

The 2008 Global Financial Crisis provides a stark example. From October 2007 to March 2009, the S&P 500 lost approximately 57% of its value. What followed, however, was a remarkable recovery:

• Within one year of the March 2009 bottom, the market had gained approximately 70%

• By 2013, just four years after the bottom, the S&P 500 had fully recovered all its losses

• Investors who exited during the downturn and failed to re-enter missed one of the strongest bull markets in history

According to data from Fidelity Investments, the S&P 500 has recovered from bear markets (declines of 20% or more) in an average of 3.3 years since 1946. More impressively, in five of the eleven bear markets during this period, the recovery took less than two years.

The COVID-19 pandemic created another instructive case study. In March 2020, the S&P 500 plunged 34% in just 23 trading days--the fastest bear market in history. Yet by August 2020, barely five months later, the index had fully recovered its losses and gone on to reach new all-time highs.

Investors who fled the market during the panic would have locked in substantial losses and missed the subsequent rally.

The Psychology Behind Market Timing Failures

Market timing doesn't just fail because markets are unpredictable--it fails because human psychology makes consistent success nearly impossible.

Behavioural Biases

Several cognitive biases undermine most investors' market timing attempts:

• Loss aversion: Studies show that the pain of losing money is psychologically about twice as powerful as the pleasure of gaining the same amount. This leads investors to exit markets too quickly during downturns.

• Recency bias: Giving too much weight to recent events, causing investors to project current trends indefinitely into the future.

• Confirmation bias: Seeking information that confirms pre-existing beliefs while ignoring contradictory evidence.

• Herd behaviour: Following what others are doing rather than adhering to a rational investment plan.

Research by Dalbar, Inc. illustrates the real-world impact of these biases. Their annual "Quantitative Analysis of Investor Behaviour" study consistently shows that average investors significantly underperform the market indexes primarily due to poorly timed buy and sell decisions.

For the 30-year period ending December 31, 2018, while the S&P 500 returned an average of 10.0% annually, the average equity fund investor earned just 4.1% annually--a shortfall largely attributed to market timing mistakes.

The Power of Time in the Market

Historical data overwhelmingly supports the superiority of maintaining consistent market exposure over attempting to time entries and exits.

Compounding: The Eighth Wonder of the World

Albert Einstein allegedly called compound interest "the eighth wonder of the world." The principle applies powerfully to market investing: returns generating additional returns over time create exponential growth. However, this mechanism only works with sustained market participation.

A 2021 analysis by Hartford Funds examined hypothetical $10,000 investments in the S&P 500 over 30-year periods. They found that $10,000 invested from 1990-2020 would have grown to approximately $172,000 if fully invested throughout. However, missing just the 25 best-performing days would have reduced that sum to around $32,000--a reduction of roughly 81%.

Historical Performance Over Different Time Horizons

Another compelling argument for time in the market comes from examining historical returns across different holding periods:

• Daily returns: Historically, the S&P 500 has been nearly a 50/50 proposition on a daily basis, with positive returns occurring roughly 53% of trading days.

• One-year periods: According to data from Charles Schwab, from 1926 through 2019, the S&P 500 produced positive returns in 74% of calendar years.

• Five-year periods: When examining rolling five-year periods over the same timeframe, positive returns occurred 87% of the time.

• Twenty-year periods: For all rolling 20-year periods since 1926, the S&P 500 has never produced a negative return.

This progressive improvement in success rates over longer time horizons powerfully illustrates why patience is a virtue in investing.

Strategic Approaches for Long-Term Investors

Rather than attempting market timing, investors should consider these evidence-based approaches:

1. Dollar-Cost Averaging

This strategy involves investing fixed amounts at regular intervals regardless of market conditions. By purchasing more shares when prices are low and fewer when prices are high, investors can lower their average cost per share over time while avoiding the stress of timing decisions.

2. Risk-Adjusted Portfolio Construction

Properly calibrated portfolios aligned with an investor's risk tolerance enable them to remain invested through market volatility. A balanced portfolio that an investor can comfortably maintain through market cycles is far more likely to succeed than one that prompts panic selling during downturns.

3. Regular Rebalancing

Periodically adjusting portfolio allocations back to target weights serves as a disciplined, systematic approach to buying low and selling high without attempting to predict market movements.

Conclusions

While the temptation to time the market remains strong, especially during periods of heightened volatility, the evidence overwhelmingly favours patient, consistent investing.

The combination of unpredictable market movements, rapid recoveries following downturns, and common behavioural biases creates nearly insurmountable challenges for market timers.

Instead, investors who maintain disciplined market exposure through diverse, risk-appropriate portfolios positioned for long-term growth have historically been rewarded. As the data demonstrates, it's not about timing the market but time in the market that ultimately builds wealth.

In investment, as in many endeavours, patience truly is a virtue--and often the difference between financial success and disappointment.

Further reading :

Managing Investment Uncertainty

Learn why we recommend award winning DFM services for investors

James Penny, Chief Investment Officer at TAM International talked eloquently on this subject in a webinar entitled "It's not about timing the market, but time in the market" that can be viewed here