Moratorium vs Full Medical Underwriting Guide

Filed in: Medical Insurance

05 September 2025

The Medical Insurance Choice That Could Cost You Thousands

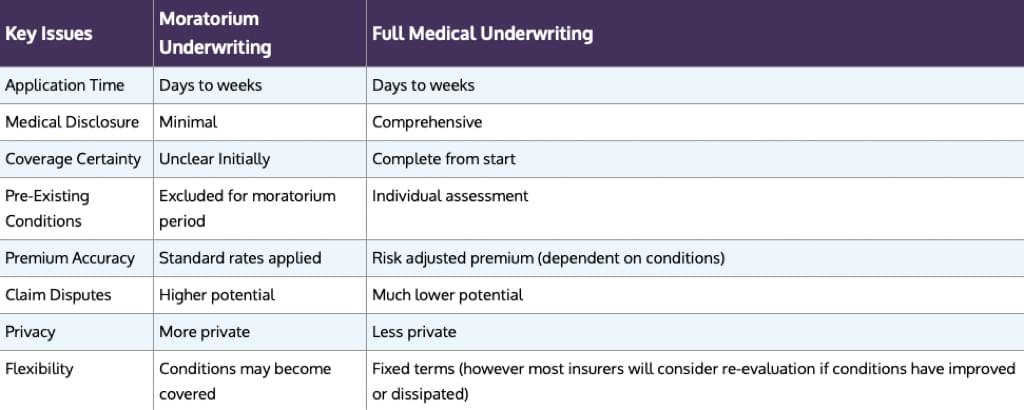

• Two Distinct Approaches: Moratorium underwriting offers quick coverage with automatic exclusions for pre-existing conditions (typically 24 months), while full medical underwriting provides complete coverage clarity upfront through comprehensive medical assessment.

•Speed vs Certainty Trade-off: Moratorium underwriting prioritises rapid policy issuance and privacy but creates uncertainty about what's covered, whereas full medical underwriting takes longer to process but eliminates surprises through detailed upfront evaluation.

• Context-Dependent Benefits: The right choice depends on individual circumstances - busy professionals with minor health issues may benefit from moratorium underwriting's speed, while those with complex medical histories need full underwriting's clarity and tailored coverage.

• Professional Guidance Essential: Given the complexity and long-term implications of these choices, working with an experienced, client-focused advisor (not company representatives) is crucial for selecting the appropriate approach and avoiding costly coverage gaps or claim disputes.

Private Medical Insurance Underwriting: Understanding Moratorium vs Full Medical Underwriting

When purchasing private medical insurance, one of the most critical decisions you'll face is choosing between two distinct underwriting approaches: moratorium underwriting and full medical underwriting.

This choice can significantly impact your coverage, premiums, and future claims experience. Understanding these approaches is essential for making an informed decision that best serves your healthcare needs and financial circumstances.

What is Medical Insurance Underwriting?

Medical insurance underwriting is the process insurers use to assess the risk of providing coverage to an individual. This assessment determines whether to offer coverage, what conditions to exclude, and what premium to charge. The underwriting approach affects how your pre-existing medical conditions are handled and what coverage you'll ultimately receive.

Why Do Two Distinct Approaches Exist For Medical Insurance Underwriting?

The existence of both moratorium and full medical underwriting approaches serves different needs for both insurers and clients in respect of expat medical insurance plans:

For insurers

- Risk Management: Different approaches allow insurers to manage risk exposure while remaining competitive

- Market Segmentation: Catering to different customer preferences and risk profiles

- Operational Efficiency: Moratorium underwriting reduces initial administrative costs and speeds up policy issuance

- Competitive Positioning: Offering choice helps insurers differentiate themselves in a crowded marketplace

For Clients

- Speed vs Certainty: Some clients prioritise quick policy issuance, while others prefer clarity about coverage

- Privacy Preferences: Different comfort levels with medical disclosure

- Health Status: Individuals with complex medical histories may benefit from different approaches

- Risk Tolerance: Varying preferences for uncertainty about future coverage

Moratorium Underwriting: The Quick Start Approach

Moratorium underwriting is a streamlined approach that allows you to obtain coverage quickly without extensive medical disclosure upfront.

How Moratorium Insurance Plans Work

Under moratorium underwriting, you complete a basic application with minimal health questions, typically asking only about:

- Recent medical consultations or treatments

- Ongoing medical conditions requiring treatment

- Pending medical investigations or treatments

The insurer then applies a "moratorium period" (usually 24 months) to any undisclosed pre-existing conditions.

During this period, you cannot claim for treatment related to these conditions.

Key Features Of Moratorium Underwriting

- Quick Application: Policies can often be issued within days

- Limited Medical Questions: Minimal health disclosure required initially

- Automatic Exclusions: Pre-existing conditions are automatically excluded for the moratorium period

- Potential Future Coverage: Conditions may become covered after the moratorium period if no symptoms or treatment occur.

Advantages Of Moratorium Underwriting

- Speed: Fast policy issuance, ideal for urgent coverage needs

- Privacy: Less invasive medical questioning

- Simplicity: Straightforward application process

- No Medical Examinations: Usually no need for medical reports or examinations

- Future Flexibility: Potential for excluded conditions to become covered later

Disadvantages Of Moratorium Underwriting

- Uncertainty: Unclear what conditions are excluded until you need to claim

- Potential Claim Disputes: Arguments may arise about what constitutes a pre-existing condition

- Hidden Exclusions: You might unknowingly be excluded from coverage you expected

- Limited Immediate Coverage: Many conditions won't be covered initially

- Premium Charges: Some insurers charge more for their moratorium contracts

Full Medical Underwriting: The Comprehensive Approach

Full medical underwriting involves a thorough assessment of your medical history before the policy is issued, providing complete clarity about your coverage from day one.

How Full Medical Insurance Works

The full medical underwriting process typically includes:

- Comprehensive medical questionnaire covering your entire medical history

- Access to your medical records from your hospital or GP

- Sometimes medical examinations or additional tests are required

- Individual assessment of each medical condition

- Specific terms and exclusions clearly defined before policy commencement

Key Features Of Full Medical Underwriting

- Complete Disclosure: Full medical history review

- Individual Assessment: Personalised evaluation of each condition

- Clear Terms: All exclusions and limitations defined upfront

- Immediate Clarity: You know exactly what's covered from day one

- Tailored Premiums: Pricing reflects your specific risk profile

Advantages Of Full Medical Underwriting

- Complete Certainty: Clear understanding of what is and isn't covered

- No Surprises: Defined exclusions prevent claim disputes

- Potential For Better Terms: Some conditions might be covered that would be excluded under moratorium

- Transparent Pricing: Premiums accurately reflect your risk

- Peace of Mind: Confidence in your coverage scope

Disadvantages Of Full Medical Underwriting

- Time-Consuming: Process can take several weeks

- Intensive Disclosure: Requires detailed medical history

- Potential Exclusions: Some conditions may be permanently excluded

- Higher Premiums: May result in increased costs for higher-risk individuals

- Possible Decline: Risk of being refused coverage entirely

Case Study 1: The Busy Executive - Moratorium Underwriting

Scenario: Sarah, a 35-year-old management consultant, needs expat private medical insurance quickly due to a new job requirement. She has a history of occasional back problems but hasn't sought treatment in the past year.

Why Moratorium Medical Insurance Underwriting Works Here:

Benefits

- Speed: Policy issued within 48 hours, meeting her employment deadline

- Convenience: Minimal paperwork during her busy schedule

- Privacy: No need to disclose old back issues in detail

- Future Potential: If her back remains problem-free for 24 months, it could become covered

Drawbacks

- Immediate Risk: If her back problem flares up in the first 24 months, treatment won't be covered

- Uncertainty: She's unsure what other minor conditions might be excluded

- Potential Higher Costs: May pay for treatment out of pocket initially

- Justification: The speed and convenience of moratorium medical insurance underwriting suits Sarah's immediate needs, and her relatively minor health issues make the risk acceptable.

Dangers of Using Full Medical Underwriting Instead:

- Timing Risk: Delayed coverage could jeopardise her employment opportunity

- Unnecessary Complexity: Over-analysis of minor conditions might result in permanent exclusions

- Opportunity Cost: Delaying coverage leaves her unprotected during the application process

Case Study 2: The Health-Conscious Retiree - Full Medical Underwriting

Scenario: Robert, a 58-year-old recent retiree, has a history of high blood pressure, mild diabetes, and a previous minor heart procedure. He wants comprehensive coverage and has time to complete a thorough application.

Why Full Medical Insurance Underwriting Works Here:

Benefits

- Complete Clarity: Knows exactly what's covered for his existing conditions

- Tailored Coverage: Individual assessment might result in better terms than automatic exclusions

- No Claim Surprises: Clear understanding prevents disputes when treatment is needed

- Accurate Pricing: Premium reflects his actual risk level

Drawbacks

- Time Investment: Several weeks to complete the process

- Detailed Disclosure: Must provide comprehensive medical records

- Potential Exclusions: Some conditions might be permanently excluded

- Possible Premium Increases: Risk-adjusted pricing might be higher

- Justification: Robert's complex medical history requires careful assessment to ensure appropriate coverage, and he has the time to complete the process properly.

Dangers of Using Moratorium Medical Underwriting Instead:

- Hidden Exclusions: His known conditions would definitely be excluded for 24 months

- False Economy: Paying premiums for coverage he can't immediately use

- Claim Disputes: Potential arguments about what constitutes pre-existing conditions

- Inadequate Coverage: Risk of needing treatment for excluded conditions during the moratorium period

The Dangers of Choosing the Wrong Medical Insurance Underwriting Approach

Risks of Inappropriate Moratorium Underwriting:

- Coverage Gaps: Paying for insurance that doesn't cover your likely needs

- Financial Shock: Unexpected out-of-pocket expenses for excluded treatments

- Claim Disputes: Stressful arguments with insurers during vulnerable times

- False Security: Believing you have comprehensive coverage when you don't

Risks of Inappropriate Full Medical Underwriting:

- Delayed Coverage: Missing urgent coverage needs due to lengthy processes

- Over-Exclusion: Permanent exclusions for conditions that might never recur

- Privacy Concerns: Excessive medical disclosure for relatively minor issues

- Opportunity Cost: Missing optimal timing for coverage due to process delays

Making the Right Choice: Key Considerations

When deciding between moratorium and full medical underwriting for your expat medical insurance plan consider:

- Urgency of Coverage: How quickly do you need protection?

- Health Complexity: How extensive is your medical history?

- Risk Tolerance: How comfortable are you with uncertainty?

- Privacy Preferences: How much medical disclosure are you comfortable with?

- Financial Planning: Can you afford potential out-of-pocket expenses?

- Long-term Perspective: What are your future healthcare needs likely to be?

- How to choose an expat medical insurance plan: Learn more with our easy to read guide

The Critical Importance of Professional Advice

Navigating the complexities of private medical insurance underwriting requires expertise that goes beyond basic product knowledge. This is where the value of working with an experienced, qualified advisor becomes paramount.

Why You Need Client-Focused Advice:

Independent Perspective: Advisors who work on behalf of clients, not insurance companies, can provide unbiased recommendations based solely on your best interests.

Market Knowledge: Experienced advisors understand how different insurers handle various medical conditions and can guide you to providers most likely to offer favourable terms.

Process Expertise: They can help you navigate the application process efficiently, ensuring proper disclosure while avoiding unnecessary complications.

Long-term Planning: Good advisors consider not just your immediate needs but your likely future requirements and how different approaches will serve you over time.

Claim Support: When you need to make a claim, having an advisor who understands your policy inside and out can be invaluable.

Red Flags: Company-Focused Advice

Be wary of advisors who:

- Recommend the same insurer regardless of your circumstances

- Push for quick decisions without thorough needs analysis

- Minimise the importance of understanding policy terms

- Receive significant commissions from particular insurers

- Don't explain the long-term implications of your choices

The Value Proposition

While it might seem straightforward to purchase medical insurance directly, the complexity of underwriting approaches, policy terms, and insurer differences means that professional guidance often pays for itself through:

- Better-suited coverage selection

- Avoiding costly mistakes

- Optimising the application process

- Reducing claim disputes

- Long-term relationship management

Conclusion

The choice between moratorium and full medical underwriting is not simply a matter of preference - it's a strategic decision that can significantly impact your healthcare coverage and financial well-being. Each approach serves specific circumstances and client needs, but choosing the wrong one can result in inadequate coverage, financial surprises, or unnecessary complications.

Moratorium underwriting offers speed and simplicity but comes with uncertainty and potential gaps in coverage. Full medical underwriting provides clarity and tailored coverage but requires time and comprehensive disclosure. The key is matching the approach to your specific circumstances, health status, and coverage needs.

Most importantly, this is not a decision to make in isolation. The complexity of modern medical insurance, the variety of insurer approaches, and the long-term implications of your choices make professional advice not just valuable but essential. Working with an experienced, qualified advisor who represents your interests--not those of insurance companies--can mean the difference between coverage that truly protects you and coverage that fails when you need it most.

Take the time to understand your options, seek qualified advice, and make an informed decision that will serve your healthcare needs both today and in the future. Your health and financial security are too important to leave to chance or uninformed decision-making.

Further Reading

Medical Insurance Plans Covering Cancer Issues

The Psychological Impact of Prostate Cancer

Understanding The Medical Evacuation Process

Acute Onset Of Pre-Existing Medical Conditions Cover

Learn The Difference In Medical Insurance Policy Excess Wording

The Power Of Expat Medical Insurance To Save Life

A Cautionary Note Regarding “Home Country” Travel Medical Insurance Benefits