When Boring Gets Interesting

Filed in: Momentum |Investment |Pensions |Savings |Economy

15 October 2024

Chinese Market Analysis: Monetary Stimulus and Economic Outlook

Key Points Summary

- Defensive stocks typically offer stable earnings and low volatility but have underperformed since 2022.

- Rising interest rates and AI excitement have contributed to the underperformance of defensive stocks.

- Changing market conditions, including falling interest rates, may lead to future outperformance of defensive stocks.

What this chart shows

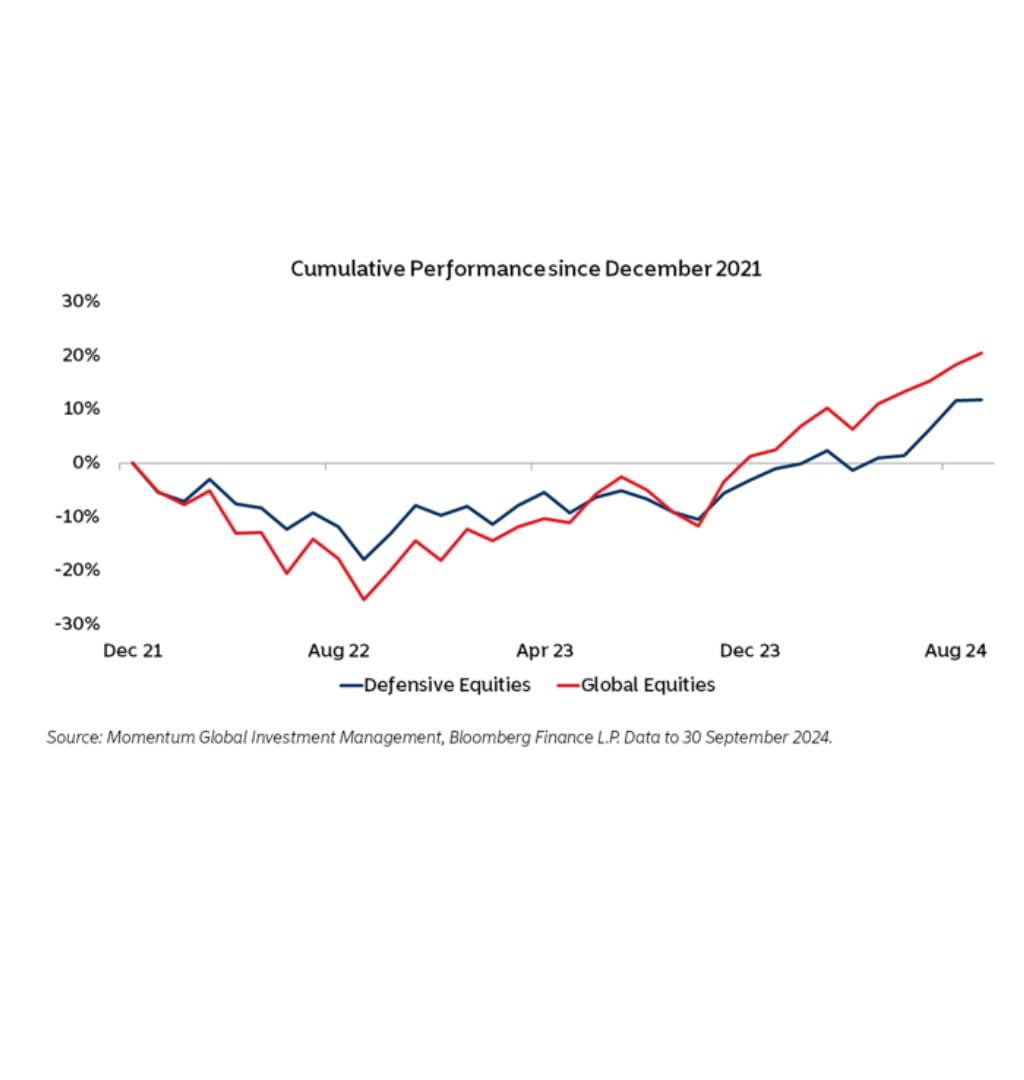

This chart shows the cumulative performance of defensive equities, here approximated using the MSCI World Minimum Volatility Index, and of the market-cap weighted global equity index, since the end of 2021.

Defensive stocks, present across all industries but most readily identifiable within financials, health care, real estate and infrastructure typically exhibit low share price volatility, thanks to their “bond-like” features of stable earnings generation, low reliance on the business cycle and predictable growth rates.

Some people call them “boring” because they have nothing to do with the exciting world of technologic innovation; they rarely surprise investors with great earning revisions; and they rarely make the front page. Since 1 January 2022, defensive stocks have underperformed by about 8%, despite having outperformed by almost 9% in the sell-off in early 2022.

Why this is important

Over the long-run, one can expect defensive stocks to deliver equity-like returns with bond-like volatility, but over the short-term they can easily deviate from broader equities by a significant amount, often (but not necessarily) lagging in a strong rally and outperforming when markets fall.

Since mid-2022, the rising interest rate environment has punished them for their bond-like characteristics, and the absence of any relation to AI (the dominating theme over the past two years) has made them even less attractive, leading to substantial underperformance and a significant relative discount against market-cap weighted equities.

Now that the tides are turning, with rates coming down and excitement around AI dissipating, Momentum Asset Management believe this is a very attractive part of the market that should outperform if things continue on this trajectory, especially should global growth slow.