Learning From The MOVE Index

Filed in: Momentum |Investment |Pensions |Savings |Economy

29 October 2024

What Is the Merrill Option Volatility Index (MOVE)?

Key Points Summary

• Interest Rate Risk Management: By measuring implied volatility in the Treasury market, the MOVE index helps investors understand the sensitivity of bond prices to future interest rate changes. This is crucial information for managing interest rate risk in fixed-income portfolios.

• Navigating Uncertainty: The MOVE index provides insight into how political, policy, and fiscal risks are impacting the bond market. Closely tracking the index can help investors identify periods of heightened volatility and uncertainty, informing their decisions around portfolio hedging and overall market sentiment.

Understanding The MOVE Index

The MOVE (Merrill Option Volatility Estimate) Index is a widely watched indicator that measures the implied volatility in the U.S. Treasury market. It does this by tracking the prices of one-month options on 2-year, 5-year, 10-year and 30-year Treasuries. This provides a real-time gauge of market expectations for near-term price movements and uncertainty in the bond market.

A higher MOVE Index reading signals that options traders anticipate greater volatility in Treasury prices over the coming month. Conversely, a lower MOVE Index indicates an expectation of calmer conditions and lower price swings for government bonds.

Why the MOVE Index Matters for Investors

The MOVE Index is an invaluable tool for investors to monitor the state of the fixed-income market and gauge overall market sentiment. Here are some key reasons why the MOVE Index is so important:

1. Recession Indicator: Spikes in the MOVE Index are often harbingers of economic downturns. When bond market volatility surges, it can signal growing fears about the economic outlook, potential policy missteps by the Federal Reserve, or other systemic risks. Closely tracking the MOVE Index can give investors an early warning of looming recessions.

2. Interest Rate Sensitivity: The MOVE Index helps investors understand how sensitive Treasury prices and yields may be to future interest rate changes. Higher MOVE levels imply that bond prices could see larger swings in response to monetary policy decisions or economic data releases. This is crucial information for managing interest rate risk in bond portfolios.

3. Policy Uncertainty: As seen in the recent sharp jump in the MOVE Index, political and policy uncertainty can significantly impact the Treasury market. Investors need to monitor the MOVE to gauge how much bond volatility may be driven by factors like elections, fiscal policy debates, or geopolitical tensions.

4. Portfolio Hedging: For investors holding fixed-income assets, the MOVE Index can be a valuable tool for assessing when to employ volatility-dampening strategies, such as increased diversification or the use of Treasury options and futures. Hedging bond portfolio risk becomes especially important when the MOVE Index is elevated.

5. Market Sentiment: Beyond its technical applications, the MOVE Index also serves as a broad barometer of market sentiment. Spikes in the index often coincide with periods of heightened risk aversion, flight-to-quality flows, and overall uncertainty among investors. Monitoring the MOVE can help investors stay attuned to shifts in market psychology.

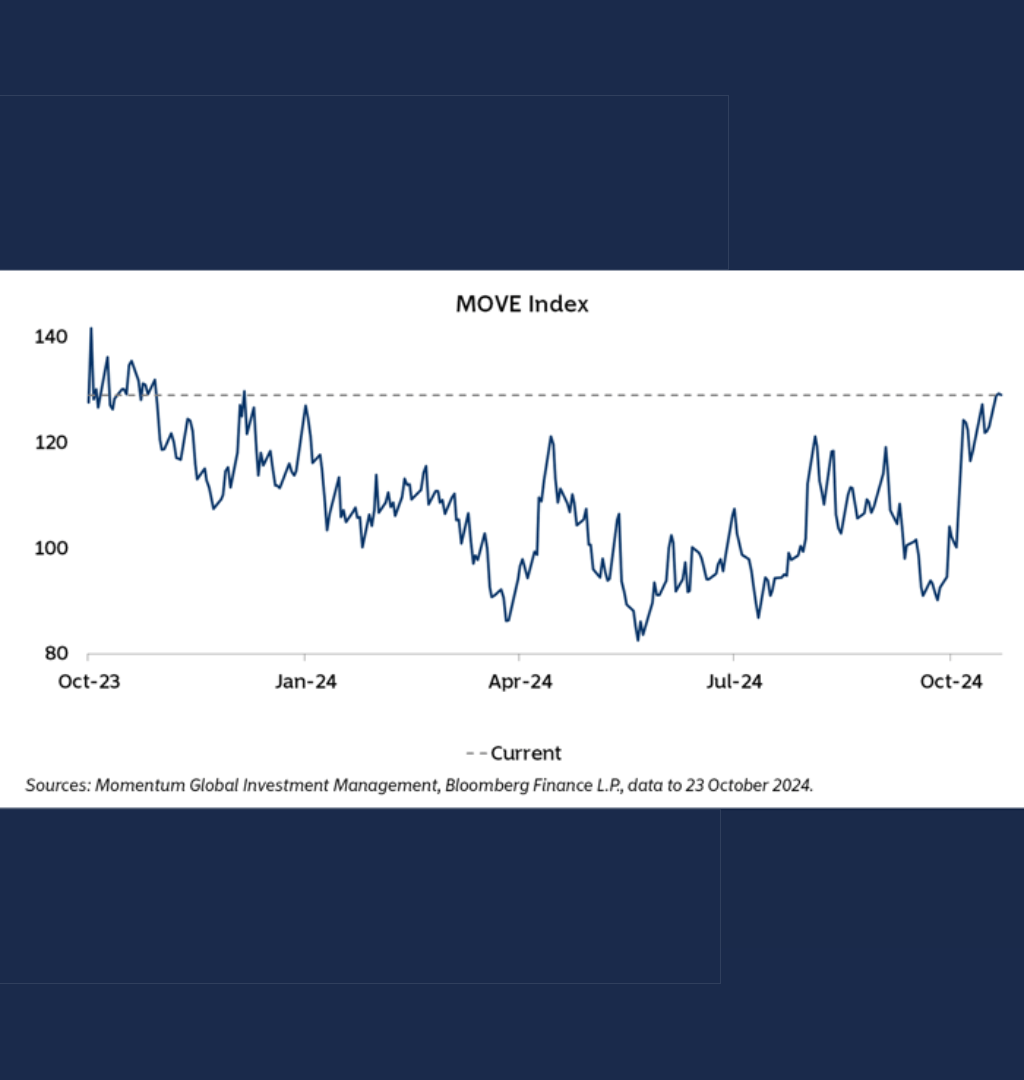

Interpreting the MOVE Index in Today's Environment

The recent surge in the MOVE Index, as highlighted in the original article, reflects the growing sense of volatility and instability in the U.S. Treasury market. Several key factors are contributing to this environment:

• Doubts about the Fed's Policy Path: Despite recent rate cuts, strong economic data has led markets to question the likelihood of further aggressive easing. This uncertainty is driving bond market fluctuations.

• Political and Policy Risks: The upcoming U.S. presidential election is introducing significant policy uncertainty, with investors concerned about the potential impact of a Trump victory on trade policy and fiscal stimulus.

• Inflation Concerns: Rising inflation expectations, fueled by factors like the proposed tariffs, are eroding bond prices and pushing yields higher.

• Fiscal Sustainability Fears: Warnings about the unsustainable trajectory of the U.S. national debt are exacerbating bond market jitters.

In this context, the elevated MOVE Index signals that Treasury investors should expect continued volatility and be prepared to adjust their portfolios accordingly.

Closely monitoring the MOVE can help investors navigate the turbulent fixed-income landscape and make more informed decisions about their bond exposures.