Chinese Economic Stimulus

Filed in: Momentum |Investment |Pensions |Savings |Economy

08 October 2024

Chinese Market Analysis: Monetary Stimulus and Economic Outlook

Key Points Summary

- Market Surge: Chinese equities experienced their strongest rally since 2008, with the CSI 300 gaining 24% over five sessions following new stimulus measures, highlighting a dramatic shift in market sentiment.

- Policy Response: The PBoC has implemented significant monetary easing through rate cuts and reserve requirement adjustments, signaling strong commitment to supporting economic growth.

- Structural Hurdles: Despite positive market reaction, China faces fundamental challenges including property sector weakness, local government debt stress, demographic decline, and high youth unemployment.

- Critical Juncture: While stimulus may help achieve the 5% growth target for 2024, long-term success depends on balancing immediate support with meaningful structural reforms to address underlying economic imbalances.

Recent Market Performance

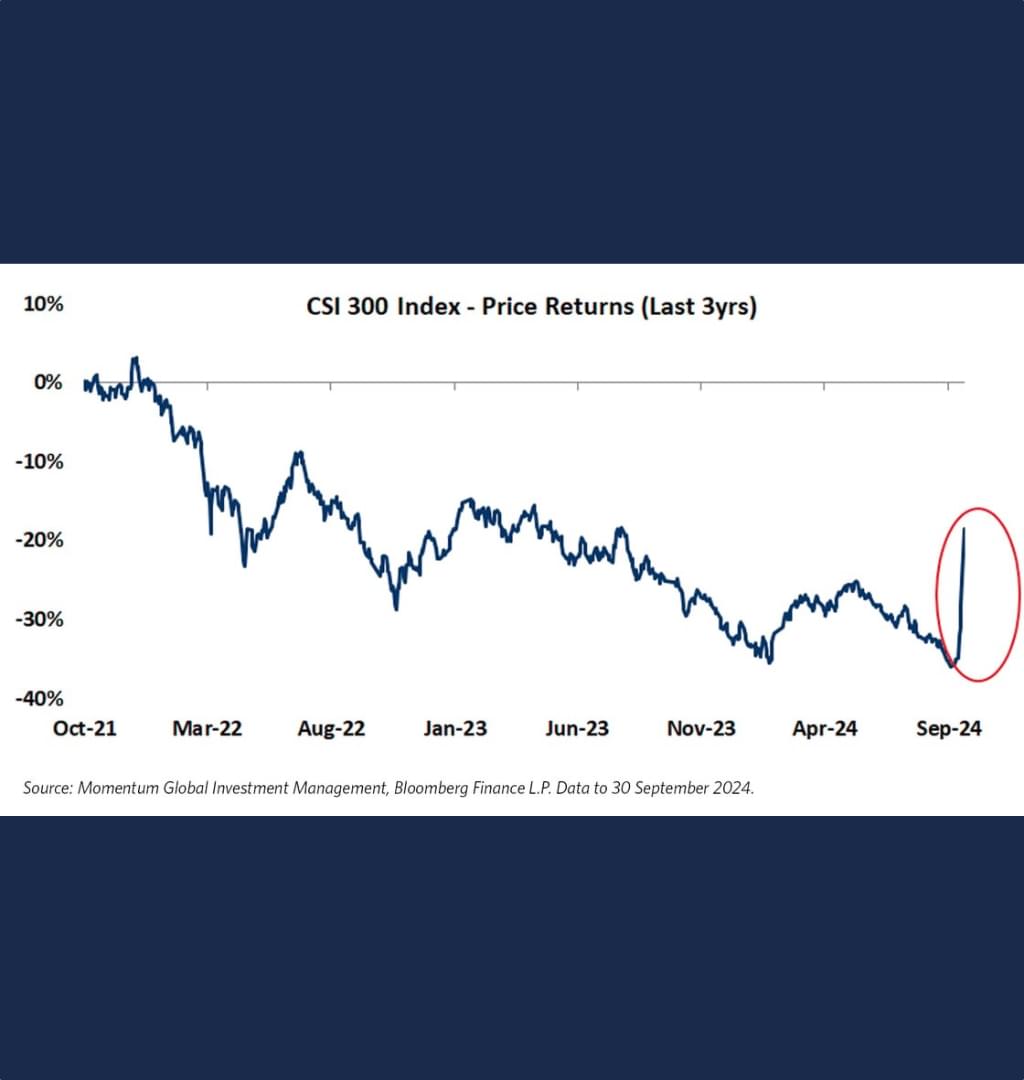

The Chinese equity market, as measured by the CSI 300 index, has demonstrated remarkable short-term performance following recent monetary stimulus announcements. Most notably:

1. An exceptional single-day gain of 8.5% on September 30th - the strongest daily performance since the 2008 Global Financial Crisis

2. A cumulative 24% surge over five trading sessions following the stimulus announcement

3. This rally represents a significant deviation from the previous three years of underwhelming returns

Stimulus Measures

The People's Bank of China (PBoC) implemented several key monetary policy adjustments:

1. A 20 basis point reduction in the main policy rate

2. A 50 basis point cut to the reserve requirement ratio (RRR)

3. These measures aim to inject liquidity into the banking system and support economic activity

Stimulus Challenges

Despite the positive market reaction, China's economy faces several significant structural headwinds:

Property Sector

1. Continued weakness in the real estate market

2. Outstanding issues with major developers' debt

3. Declining property values affecting household wealth

4. Impact on local government revenues from land sales

Local Government Finances

1. Significant debt levels at the provincial and municipal levels

2. Reduced revenue streams from property-related activities

3. Growing concern about the sustainability of local government financing vehicles (LGFVs)

Employment Challenges

1. Persistently high youth unemployment

2. Structural mismatches in the labor market

3. Growing competition for white-collar jobs among graduates

Demographic Pressures

1. Accelerating population aging due to historical one-child policy

2. Shrinking working-age population

3.Increasing pension and healthcare costs

4. Potential impact on long-term productivity and growth

Forward Outlook

Near Term Prospects

1. The stimulus measures appear sufficient to support the government's 5% growth target for the current year

2.Market sentiment has improved significantly, though sustainability remains uncertain

3. Potential for additional fiscal measures to complement monetary policy

Long Term Considerations

1. Success will depend on structural reforms beyond monetary stimulus

2. Need for :

- Consumer confidence restoration

- Property market stabilisation

- Local government debt resolution

- Private sector investment encouragement

- Innovation and productivity enhancement

Investment Implications

1. Recent equity market rally suggests investors are pricing in more comprehensive support measures

2. Valuations remain relatively attractive compared to other major markets

3. However, successful execution of reforms will be crucial for sustained performance

4. Investors should monitor :

- Implementation of promised fiscal stimulus

- Progress on structural reforms

- Global trade relations

- Private sector confidence

- Consumer spending patterns

Conclusion

While recent monetary stimulus has catalysed a significant market response, China's economic trajectory will depend on successfully addressing deeper structural challenges. The government's commitment to both monetary and fiscal support provides some optimism, but investors should maintain a balanced view, considering both the opportunities and risks in the world's second-largest economy.

*Note: Future market performance will likely be influenced by the effectiveness of policy implementation and the global economic environment.*