The Impact Of Wars On Equity Markets

Filed in: Momentum |Investment |Pensions |Savings |Economy

07 March 2022

by MGIM

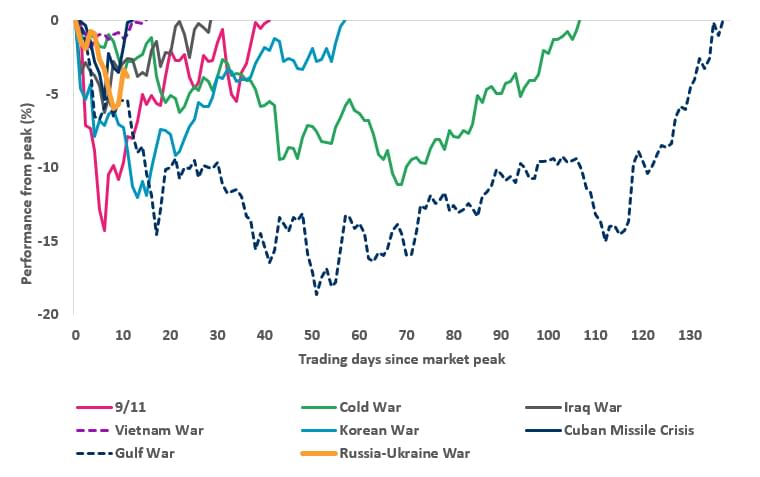

What does the "Impact Of Past Wars conflicts vs Equity Markets" chart below show?

Given recent events, we thought it would be a good opportunity to examine past wars/conflicts and analyse the drawdowns of the US equity market (as measured by the Dow Jones Industrial Average index) and how long it took for the index to return to its prior peak.

Major wars clearly impact stock markets by creating uncertainty, hitting investor sentiment, and potentially damaging economic activity.

However, analysing past military conflicts shows that permanent damage wasn’t inflicted on markets, and that they do eventually recover.

The Dow Jones initially sold off around 6% from 10th February but has rebounded since. For most events charted, markets returned to their prior peak in less than 60 trading days (3 months).

The exceptions are the Cold War and the Gulf War which took 107 and 137 trading days respectively to recover. Whilst these might look significantly longer than the other events charted, during WWII it took the Dow 1,368 trading days to recover and throughout the Global Financial Crisis it took 1,359 trading days.

In all of the conflicts charted, the US equity market never fell more than 20%.

Why is this important in relation to conflicts and equity markets?

The rapid and alarming turn of events in Ukraine has shaken markets and compounds an already uncertain environment due to high inflation and central bank monetary tightening. Momentum Asset Management expect the direct global economic impact to be limited as Ukraine and Russia are smaller economies compared to more developed economies.

This unwelcome turn of events in Eastern Europe is unlikely to cause a major bear market but rather a short-term shock. Momentum Asset Management do not underestimate the disaster that this brings but wars do end and this one is expected to be of limited duration and spread.

It comes at a time when the global economy and corporate sector are recovering robustly from the Covid-19 pandemic and while there is likely to be some knock to confidence, directly from the escalation in Ukraine and from second-order effects including higher energy prices, the broader impact should be limited.