Remaining In Safe Hands

Filed in: TAM |Investment |Pensions |Savings

02 June 2022

Markets over the last month have become noticeably more volatile than in Q1 which is hard to believe. The reasoning for this step up in fear and selling seems to be based around the idea that central banks are now actually raising rates rather than just talking about it as they were for most of the first quarter of this year. The war in Ukraine has helped to exacerbate this volatility and supercharge inflation expectations (no oil in Europe, no corn for core food production and no wiring looms for cars, to name a few) which is, in turn, feeding the flames of fear around investing into this market.

This scenario is obviously most negative for bonds as interest rises erode the value of owning bonds and likewise growth stocks come under serious pressure in a rate hiking market. We can see this with the Nasdaq down over 20% whilst the normal S&P500 only down 8.5%. It really does seem that anything which has done well prior to 2019 is now firmly at the bottom of the pile. Whilst this is regrettable, it is well known that what goes up must, at some juncture, come back down again.

As growth stocks come down, one might have expected investors to now be switching to value investing (a move which TAM made long ago). It would appear, from speaking with our competitors that invest in funds, many of whom have been so heavily invested into high growth funds for the last decade (Fundsmith and Ballie Gifford), that these peers have been somewhat reluctant to sell these holdings and are thus down over 10% at the end of the first quarter and some much more than that.

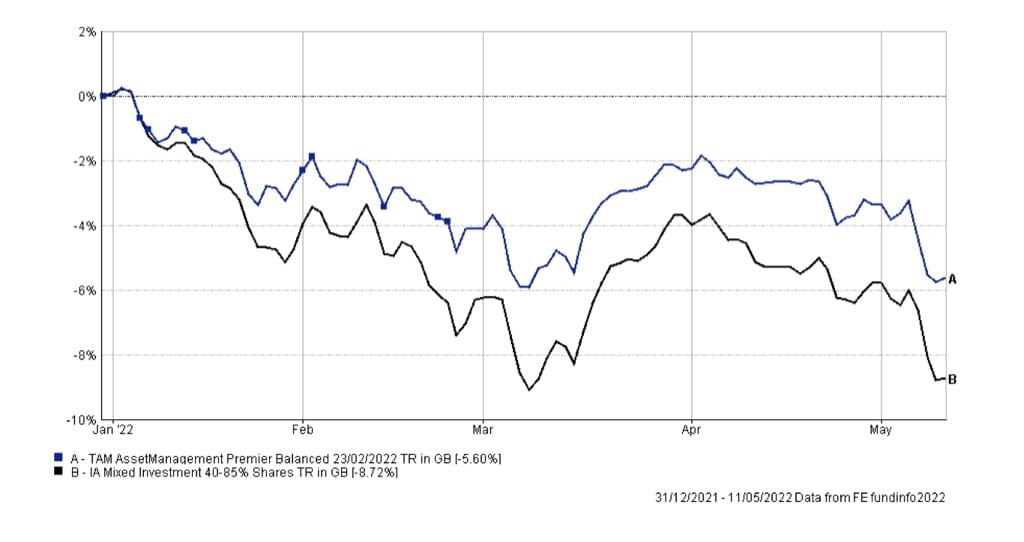

Conversely, TAM’s portfolios were down in the region of 2-6% over the first quarter which is significantly better than many competitors. This is not because we saw the writing on the wall but more that TAM has, and always will be, a cautious manager and a safe pair of hands in a crisis.

Nothing demonstrates this better than looking at TAM’s performance against the wider IA Mixed investment sector which consists of the majority of TAM’s competitors.

To my earlier comment about when TAM started buying value stocks which are so in demand now. TAM has been investing into value funds since the first vaccine came out in November 2020.

The fund we have been buying is mainly the Pzena Global Value fund and this year it’s up 1.5% when the wider market is down nearly 9%. Likewise, TAM made a switch into an S&P500 Value ETF and put it, along with Pzena, as the largest part of clients’ portfolios. This very cheap and highly effective ETF is down just 3.4% when the actual S&P500 is down 8.5%, that’s a relative performance over 150% better than the S&P500 which so many passive investors own.

Further to this, a move was taken to decrease equity exposure and increase precious metals exposure a week before the invasion of Ukraine which proved a very defensive move. Finally, a move to insulate the clients’ portfolios with healthy levels of commodities and alternative hedge fund style investments have all returned handsomely for the clients. These moves in aggregate helped to secure TAM’s position as one of the best performing DFM’s in the wider IA mixed investment sector over Q1.

Of course, this commentary is not intended to detract from the negative performance seen in clients’ portfolios this year and no one takes these negative markets more seriously than TAM. We do however think it’s worth framing this small level of underperformance against competitors offering a similar balanced investment option, suffering larger losses because of their focus on returns rather than protecting clients. To conclude, in markets like this it doesn’t do to start throwing the baby out with the bath water and panicking about every stock and bond owned and selling everything hand over fist.

The focus points for clients worrying about their invested wealth is to remain calm, remain sanguine about the fact that markets do move in fits and starts and what does go down can come back up.

TAM’s investments are geared to invest clients’ money simply, clearly and importantly invest it into the very best and highest quality companies we can find.

If we can do this whilst trying to protect clients’ assets in times of volatility then we believe this delivers the best of both worlds. I hope from my previous comments we have demonstrated that we have delivered exactly that in these trying times.

I often feel successful investing is often less about correctly predicting the outcome of every risky scenario which plagues this market and more about owning what you know to be a great investment, holding it for the longer term and getting rewarded for doing so.

And to that end, things are becoming volatile and whilst we are cognisant of this fact, we are also hugely positive for the future of this market and over the longer term this short-term shock to markets is just a great opportunity to own more high quality companies which we believe will become the winners of tomorrow’s market.

Click to watch Lester Petch and James Penny discuss TAM portfolios in more detail

Further reading :

Learn more about TAM Asset Management

Learn more about TAM ESG Portfolios