Japan - Rise And Shine

Filed in: Investment |Economy

01 April 2015

Over the years, one has learned to be a little wary of putting out bullish investment notes on Japan. The financial writing landscape is littered with the graves of bull notes written by those who thought this time was different. Headlines such as “The sun also rises” were often penned at the end of impressive stock market rallies but on the eve of a major sell off.

More often than not, this reflected the sincere belief that Japan was about to “de-couple” from the economic ups and downs of the USA, or was immune to the fickleness of the US consumer as the emerging market middle classes took their place.

There was a school of thought that wonderful things awaited Japan as it moved from a reliance on industrial manufacturing towards an economy balanced by domestic demand and service industries. It was a nice idea but was hopelessly unrealistic due to a number of economic and demographic factors which were unique to Japan and remain stubbornly embedded in the make up of the country today.

It wasn't always investors’ fault for getting it wrong. There were numerous policy errors during the two lost decades of stagnant growth. It seemed that if there was a decision that could be taken by either the Bank of Japan or the Japanese government that could wreak havoc in the economy or cause foreign investors to sell, it was usually jumped on with both feet. The resulting chaos often involved overwhelming selling and share prices being locked “limit down” with a maximum price decline being implemented but with no shares sold. Such was the life of a Japan fund manager.

But one had to avoid slipping into a bunker mentality because on the rare occasions that the sun did shine, the stock market could be up 25% in a year. At such times, it was often prudent to dispense with one’s stock picking hat and instead reach for the chart books because the only thing that mattered in the short term was owning the “right” stocks.

For example, over the years, throughout the 90’s and Noughties, if the Yen was weakening, foreign buyers piled into the Japanese exporters, many of them familiar household names such as Sony, Canon and Toyota, which were those internationals most likely to benefit from a weak Yen and an increase in the value of their repatriated profits from around the world.

The fund manager’s desk bible, the Japan Company Handbook helpfully showed each company’s export ratio; a data point rarely questioned even as company managements got better at currency hedging or moved production overseas, mitigating the positive effects of a weak Yen. But facts didn't matter very much, you just had to own them if you wanted to be along for the ride. If you were in the hedging business yourself as an investor, you could also hedge your currency exposure back into your own, thus avoiding the two-steps-forward in stock gains and one-step-back on the falling Yen.

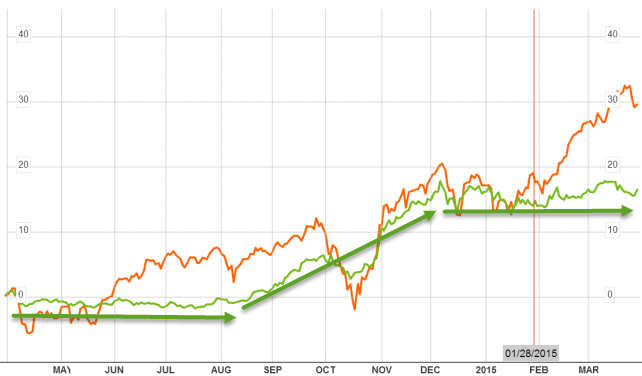

Broadly speaking, the “two steps one step” is what happened from around May last year when the Yen weakened by 17% from $/¥102 to $/¥120, sparking renewed foreign investor interest in Japanese equities. Over the same period the Topix index raced up over 30%. A classic and familiar reaction to a weaker Yen.

Yen (Green, LHS) and Japanese stocks (Topix, orange, RHS)

The first stage of the rally was supported by large foreign inflows which naturally gravitated to the large cap exporters; the obvious beneficiaries of a weak Yen.

But things have changed.

In the last five months the Yen has been remarkably stable despite the consensus forecast for further weakness. Partly this view is formed by the enormous amount of money printing under the Bank of Japan’s quantitative easing, and partly due to the widely held view that the US dollar must strengthen as a result of an inevitable rise in US interest rates, which we are still waiting for.

Yet the stock market has gone on to new post-Lehman highs. One of the main reasons for this has been the additional buying of equities by Japan’s national Government Pension Investment Fund (GIPF), who have made major changes to their asset allocations away from bonds and towards equities.

This fund, at $1.2 trillion, is the largest retirement fund in the world and, combined with the $850 billion of savings of Japan Post, a similar savings institution, a shift from 12% equities to nearer 20% represents a huge undertaking of share purchases. Actually, we have some “Abenomics” to thank here. The appointment of ex-Health Minister Yasuhisa Shiozaki, a reformist, into the oversight role to the GIPF was made by Prime Minister Abe.

This is encouraging because it vindicates the criteria (Stable Yen, domestic companies and reflation) upon which TAM invested in the Schroder Tokyo Fund and the Capital International Japan Equity Fund in early May last year and which has been a very profitable for the unhedged Japanese investments that we bought for most TAM client portfolios.

As we have stated before, the reformist agenda has a long way to go in Japan and “Abenomics”, under Prime Minister Abe, is not a panacea for the ills of the nation. One must remember that of the “three arrows” of policy changes, the first two of fiscal stimulus and monetary easing, were relatively easy to implement compared to the third: structural reforms.

Furthermore, the success of the first two is a mixed bag if the macroeconomic indicators are anything to go by. It is true that there are some reasons to be positive on the economy and we are encouraged by signs that wages, which have stagnated for decades, may finally be on the rise. But this may be happening anyway as a by-product of rising corporate profits filtering down to employees. If so, so much the better.

But in terms of what informs our investment decision in a market that has notably outperformed other developed markets over the last year, we are of the opinion that there are no quick fixes in Japan and that the unusual influence of huge domestic pension fund allocations into equities, justifies some element of profit taking. We will maintain a reduced position in Japanese equities and a mild overweight in equities overall, however.

We are now on the eve of the first quarter US corporate results season and, although not viewed as importantly as the third quarter, initial expectations are not high. We believe it is sensible to take some profits in Japan as well as other regions and reassess the situation after some key upcoming events, notably the US Federal Reserve interest rate decision and, of course, the UK election.

Source : Christian Holland Senior Investment Manager - TAM Asset Management