Copper Trends

Filed in: Momentum |Investment |Pensions |Savings |Economy

24 May 2024

Understanding Copper's Unprecedented Price Surge

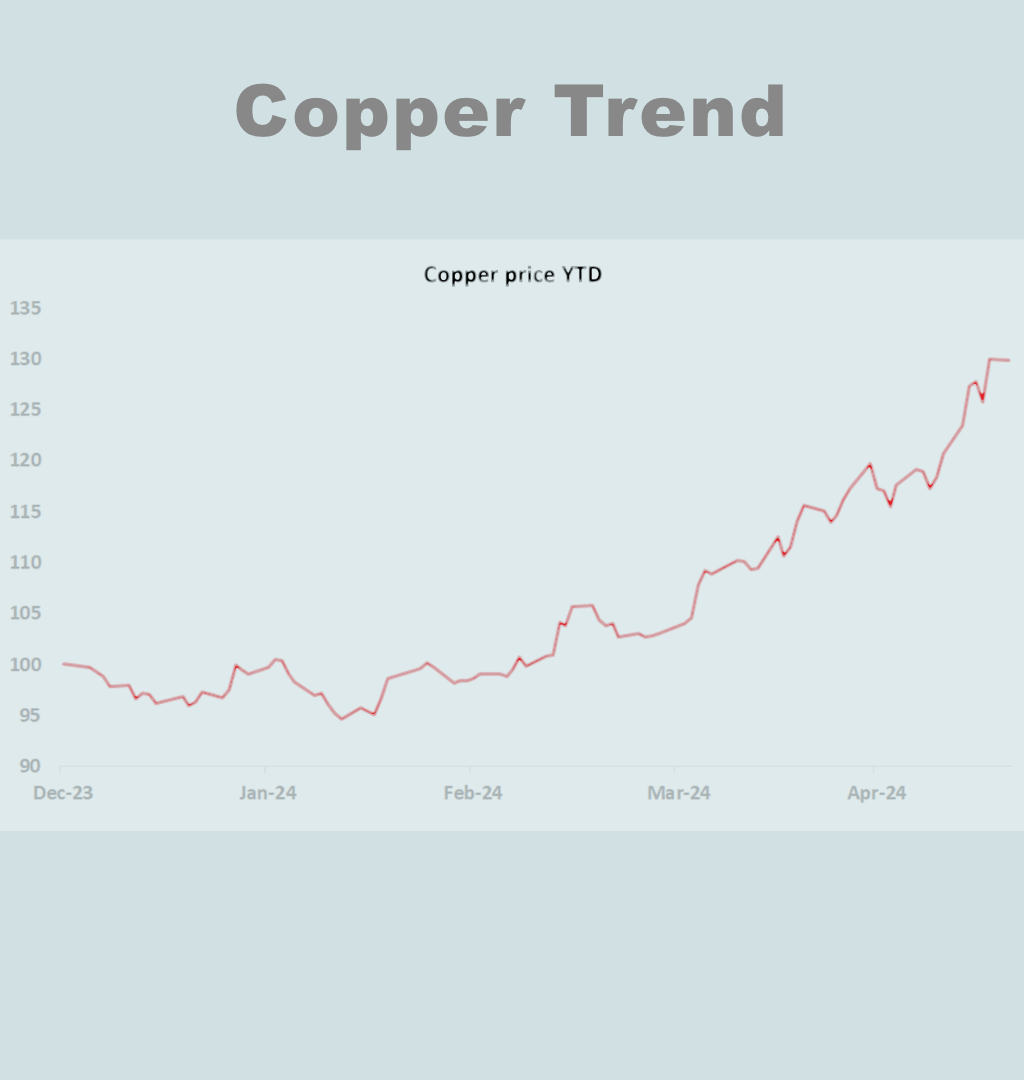

Copper prices have experienced an extraordinary surge year-to-date, reaching an unprecedented high of over $5 per pound. This marks the first time the red metal has crossed this significant threshold, leading the charge in a broader commodities rally. The chart illustrates a consistent upward trend punctuated by several sharp spikes, reflecting heightened market activity and investor interest.

Drivers of Rising Copper Demand

Several key factors are fuelling this dramatic increase in copper prices. A significant driver is the expanding investment in data centre's, artificial intelligence (AI), and the electrification of various sectors, particularly electric vehicles (EVs) and renewable energy infrastructure. These areas rely heavily on copper due to its superior electrical conductivity and versatility.

- Electric Vehicles (EVs): EVs require considerably more copper than traditional internal combustion engine vehicles, due to their reliance on electric motors, batteries, and charging infrastructure.

- Renewable Energy: Modern power grids and renewable energy systems, including wind and solar power installations, depend on copper for efficient power generation and transmission.

- Technological Advancements: The expansion of data centers and AI technologies also boosts demand for copper, as these facilities require extensive electrical wiring and components.

China's economic recovery and growth prospects have further bolstered copper demand. As the largest consumer of copper globally, China accounts for over half of the world's copper consumption, making its economic activities a critical factor in global copper markets.

Supply-Side Constraints

On the supply side, several constraints are contributing to the upward pressure on copper prices. One major issue is the lengthy timeline required to bring new copper mines into production. From initial exploration to operational status, the process typically takes about 12 years, creating a significant lag in supply response to rising demand.

Recent disruptions at major copper mines have exacerbated these supply constraints. Setbacks such as labor strikes, technical failures, and regulatory issues have impeded production, increasing concerns about potential shortfalls in the near future.

Market Dynamics and Speculation

The rally in copper prices is also influenced by speculative activities in the commodities market. A notable event was a short squeeze on the New York futures market, which triggered a global rush to secure copper. This speculative trading can amplify price movements, adding to the volatility.

Broader Implications and Caution

Copper's price surge underscores broader dynamics within the commodities market. Similar spikes have been observed in other commodities like nickel, gas, and cocoa, highlighting the market's susceptibility to supply disruptions and speculative trading.

While copper is crucial for emerging technologies and sustainable energy solutions, the speculative nature of the recent price rally calls for a cautious approach. Investors should recognise the inherent volatility and unpredictability of commodities markets.

Investment Perspective

For investors, commodities like copper can offer diversification benefits and act as a hedge against inflation. However, given their volatile nature, they should constitute only a small portion of a diversified investment portfolio. Balancing the potential benefits with the risks is essential to maintaining a stable and resilient investment strategy.

Source: Momentum Global Investment Management, Congressional Budget Office Data to March 2024.