Can US equity valuations be justified?

Filed in: Economy |Investment

17 December 2024

What Does the Chart Really Show?

Key Points Summary

- Market Valuation Context: US stocks are trading at 19.1x earnings, reflecting a significant transformation in sector composition and company fundamentals, particularly the rise of technology companies from 18% to 40% of the S&P 500's market value.

- Underlying Economic Factors: Higher stock valuations are justified by improved business efficiency, lower borrowing costs, and companies' ability to generate more cash flow, which allows for better reinvestment and shareholder returns.

- Balanced Perspective on Risk: While current market conditions appear strong, investors should remain aware of potential challenges such as inflation, monetary policy changes, and economic growth fluctuations that could impact stock valuations.

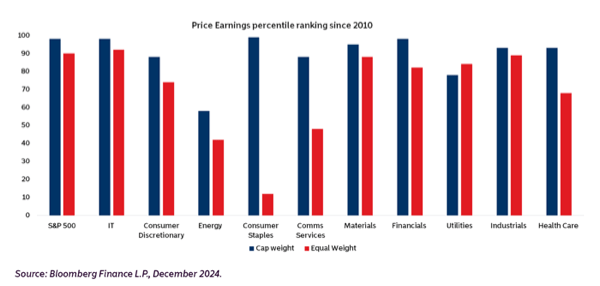

The chart provides a comprehensive snapshot of US stock market valuations, examining how current stock prices relate to company earnings across different market sectors.

At first glance, stocks appear expensive, trading at 19.1x earnings (meaning investors are paying $19.10 for every $1 of company earnings). However, this number tells a more nuanced story than simply being an indicator of overvaluation.

Key Insights into Market Valuation

1. Sector Transformation

In 2010, technology companies represented about 18% of the S&P 500's total market value. Today, that number has jumped to approximately 40%. This isn't just a size change—these companies have fundamentally improved their business models, generating faster revenue growth and achieving higher profit margins.

2. Evolving Business Efficiency

Companies across the market have become more efficient. They require less capital to operate and are generating more cash flow. When companies can generate more cash, they can:

• Invest in future growth

• Return more money to shareholders through dividends and stock buybacks

• Maintain more financial flexibility

3. Why Higher Valuations Might Make Sense Several factors support these higher stock prices:

• Lower borrowing costs: The current cost of capital is lower than historical averages

• Improved company fundamentals

• Potential for continued earnings growth

• Supportive monetary policies

Potential Risks To Consider

While the current market looks strong, investors should be aware of potential challenges:

• Inflation could disrupt monetary policies

• Economic growth might slow

• Unexpected fiscal challenges could emerge

The Bigger Picture

Contrary to simple assumptions that stock valuations always return to a "normal" level, research shows that price-to-earnings ratios typically only decrease during economic recessions. The current consensus suggests continued above-average earnings growth and supportive economic conditions.

Understanding the 19.1x Earnings Multiple

When we say stocks are trading at 19.1x earnings, here's what that means in simple terms:

• If a company earns $1 per share

• Investors are willing to pay $19.10 to own that share

• This reflects confidence in the company's future potential

• It's higher than historical averages, but not necessarily a sign of an imminent market crash

Key Takeaway

While current market valuations are high, they're supported by real improvements in company performance and economic conditions. However, investors should remain cautious and continue monitoring economic indicators.