Active Investment Management Comeback

Filed in: Investment

22 July 2025

The Renaissance of Active Fund Management: Why 2025 Signals a New Era

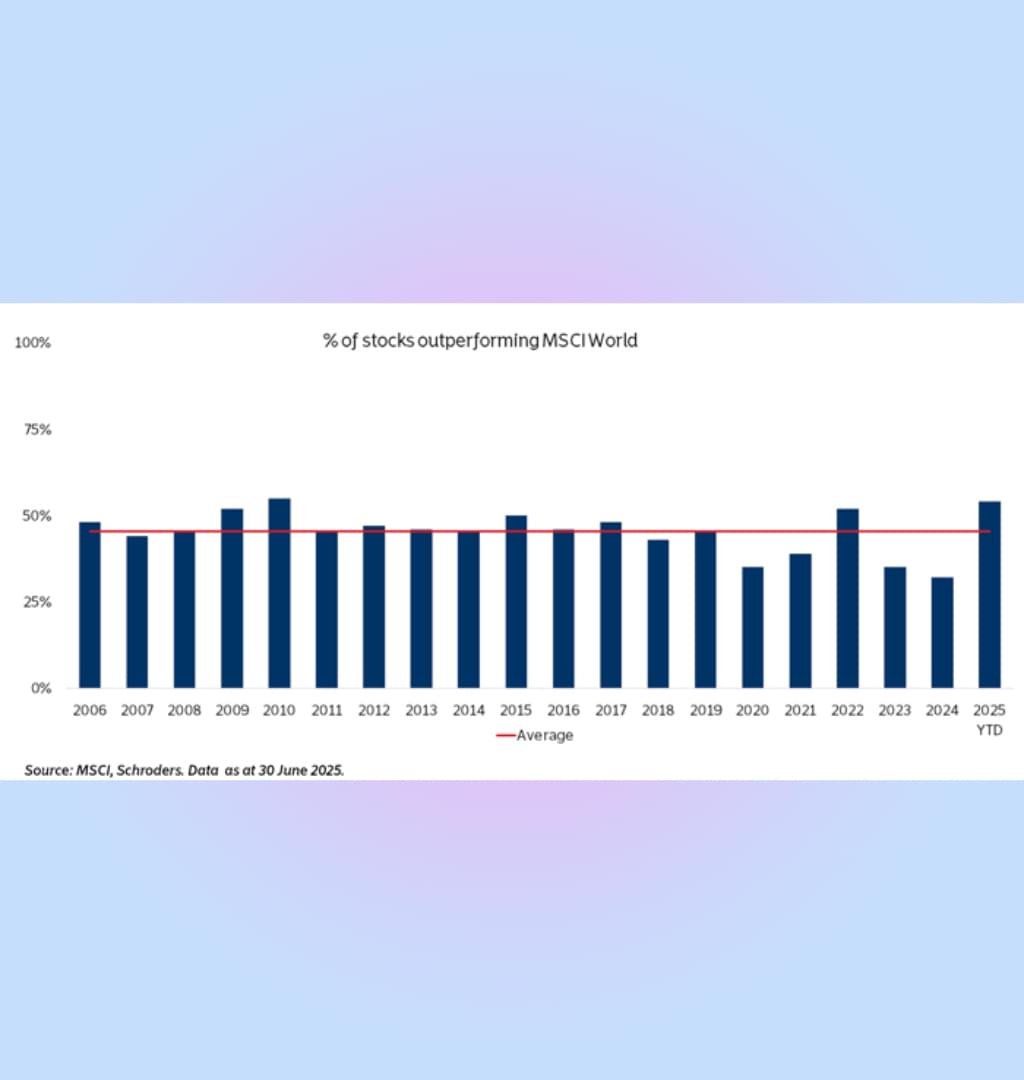

• Market Breadth is Expanding: After years of concentrated gains in mega-cap tech stocks, over 50% of stocks are now outperforming the MSCI World Index in 2025 - creating the dispersion active managers need to generate alpha through skilled stock selection.

•Active Management's Structural Advantages: Professional fund managers offer dynamic risk management, exploit market inefficiencies through deep research, and provide flexibility to adapt strategies as market conditions change - capabilities that passive indexing cannot match.

• Enhanced Alpha Generation Opportunity: With the MSCI World Ex-USA rallying 19% versus the S&P 500's 6% in H1 2025, and broader market participation replacing narrow leadership, active managers can finally leverage their security selection skills effectively.

• Professional Value Proposition: Discretionary fund management provides investors with institutional-quality research, customised solutions, professional risk oversight, and disciplined execution during market stress - delivering superior risk-adjusted returns when market breadth expands.

What the Data Reveals

The investment landscape is experiencing a profound transformation that active fund managers have been anticipating for years. After nearly two decades of challenging conditions, where passive indexing dominated performance discussions, the market dynamics captured in the above chart tell a compelling story of reversal and opportunity.

The data illustrates a critical metric: the percentage of stocks outperforming the MSCI World Index from 2006 to 2025. What we observe is a dramatic shift in market breadth, particularly evident in the most recent period. Following years where only 30-45% of stocks managed to beat the broad market index - a condition that severely handicapped active managers - 2025 shows a remarkable surge to over 50% of stocks outperforming.

This isn't merely a statistical blip; it represents a fundamental shift from the concentrated market leadership that has characterised much of the past decade. The narrow dominance of mega-cap technology stocks, while beneficial for index investors, created an environment where diversified active portfolios struggled to compete. When market gains are concentrated in just a handful of names, even the most skilled stock pickers face structural headwinds.

The recent broadening of market participation signals the end of this challenging period. With the MSCI World Ex-USA Index delivering 19% returns in the first half of 2025 compared to the S&P 500's 6%, and the S&P 493 (excluding the "Magnificent 7") finally outperforming the mega-cap cohort, we're witnessing a dispersion of returns that creates fertile ground for active management strategies.

The Compelling Case for Active Fund Management

1. Superior Alpha Generation Potential

Active fund management's primary virtue lies in its ability to generate alpha - returns above market benchmarks - through skilled security selection, timing, and risk management. When market breadth expands, as we're seeing in 2025, the opportunity set for alpha generation multiplies exponentially. Active managers can leverage their research capabilities, analytical frameworks, and market insights to identify undervalued securities before they're recognised by the broader market.

Unlike passive strategies that mechanically replicate index weights, active managers can overweight compelling opportunities and underweight or avoid entirely those securities they view as overvalued or fundamentally weak. This discretionary approach becomes particularly powerful in environments characterised by increased stock-specific performance dispersion.

2. Dynamic Risk Management and Downside Protection

One of the most under-appreciated advantages of active management is its capacity for dynamic risk adjustment. While passive investors must accept the full volatility and drawdowns of their chosen index, active managers can implement sophisticated risk management techniques including position sizing, sector allocation adjustments, and defensive positioning during market stress periods.

This flexibility proved invaluable during various market dislocations over the past decades. Active managers who successfully navigated the dot-com crash, the 2008 financial crisis, and the COVID-19 market volatility demonstrated the tangible value of human judgment and adaptive portfolio management. As markets become more complex and interconnected, this risk management capability becomes increasingly valuable.

3. Exploiting Market Inefficiencies

Despite the growth of algorithmic trading and widespread information dissemination, markets remain inefficient, particularly in mid-cap and small-cap segments, international markets, and during periods of heightened volatility. Active managers are uniquely positioned to capitalise on these inefficiencies through:

- Deep fundamental analysis that uncovers value not reflected in current market prices

- Proprietary research capabilities that generate insights unavailable to passive strategies

- Contrarian positioning that allows managers to buy quality assets when they're temporarily out of favour

- Thematic investing that capitalises on long-term structural trends before they're fully recognised by the market

4. Flexibility in Changing Market Conditions

The current market environment exemplifies why flexibility matters. As we transition from a period dominated by a few mega-cap growth stocks to one characterised by broader market participation, active managers can quickly pivot their strategies. They can rotate between growth and value styles, adjust geographic allocations, modify sector weightings, and implement factor tilts based on evolving market conditions.

This adaptability contrasts sharply with the mechanical rebalancing of passive strategies, which must maintain their predetermined allocations regardless of changing fundamentals or market dynamics.

Why Investors Benefit from Discretionary Fund Management Services

1. Customised Investment Solutions

Discretionary fund managers such as TAM International provide services that offer investors access to customised investment solutions tailored to their specific risk tolerance, investment timeline, and financial objectives. Rather than accepting the one-size-fits-all approach of broad market indices, investors can benefit from portfolios specifically constructed to meet their unique circumstances.

Professional fund managers can implement tax-efficient strategies, incorporate ESG strategies, manage concentration risk, and adjust allocations based on changing life circumstances - capabilities that passive strategies simply cannot provide.

2. Access to Institutional-Quality Research and Resources

Individual investors rarely have access to the depth of research resources available to professional fund management firms. Organisations such as at Momentum Harmony employ teams of analysts, economists, and sector specialists who conduct extensive due diligence, company meetings, and market analysis.

This research infrastructure, combined with sophisticated risk management systems and trading platforms, provides significant advantages in security selection and portfolio construction.

3. Professional Risk Managemen

Perhaps most importantly, discretionary fund management provides professional risk oversight that extends beyond simple diversification. Experienced managers understand correlation structures, can identify concentration risks, implement hedging strategies when appropriate, and most critically, maintain discipline during periods of market stress when individual investors are most prone to emotional decision-making.

The Opportunity Ahead

The market conditions illustrated in this chart suggest we may be entering a golden age for active management. As dispersion increases and market leadership broadens, the conditions that have challenged active managers for the past decade are reversing. This creates compelling opportunities for investors to reconsider their allocation to discretionary fund management services.

The renaissance of active management isn't just about potential outperformance - it's about accessing a more dynamic, flexible, and professionally managed approach to investing that can adapt to changing market conditions while providing the downside protection and risk management that becomes increasingly valuable in uncertain times.

For investors who have relied heavily on passive strategies during the era of concentrated market leadership, the current environment presents an opportune moment to evaluate the enhanced potential of active fund management in delivering superior risk-adjusted returns.