Site Search

Our site search facility enables you to look for content both within our main site and also our blog pages.

The first time a search is performed all pages are scraped for content which may take a few seconds to complete depending on your internet connectivity speed.

If you wish to search for a specific term or phrase please enable the 'ab' button within the search dialogue box

Discretionary Fund

Management

Analysis

Process

Experience

What is discretionary fund management?

Discretionary fund management firms (DFM's) solve a series of problems that private investors encounter on a daily basis. If left unchecked these problems can at best lead to poor investment performance and in worst case scenarios can lead to significant capital loss.

There are a myriad of 'banana skins' waiting to upend a private investors investment portfolio. Most misfortunes occur in making poor decisions.The lists below are just a few of the common problems investors have to contend with.

• knowing which markets to enter and which markets to avoid

• knowing which companies to purchase and which companies to sell

• timing to buy investment funds and stocks and timing when to sell

• comprehending the sometimes irrational geo-political issues

• removing emotional and natural biases that many of us are subject to

• gaining critical company data (internet based search results generally yields only partial and ordinarily old data)

• dealing with the cost of acquiring accurate and detailed research data is generally cost prohibitive

• discretionary fund managers employ highly educated individuals from the fields of economics and finance as it takes a great deal of expertise to fully understand and interpret financial data

Don't risk investment loss or investment growth because you do not have the time to research - start a conversation with us today.

Managing investment risk

To achieve successful investment outcomes, analysis, process and conviction skill sets are required.

Watch how to manage

investment risk

Processes and procedures of a Discretionnary Fund Manager

Discretionary fund managers are detail driven and operate highly efficient structures and processes in order to construct risk adjusted portfolios for clents.

We proudly partner with some of the global leaders in the discretionary fund management world that include multi-award winning TAM International and Momentum Global Investment Managers (MGIM).

The following sections provide insight to how most discretionary fund managers work to achieve steady consistent investment return results.

MANDATE CHANGES

If a fund mandates changes, its risk profile may no longer sync with your risk tolerance.

FUND PERFORMANCE

It could be that the fund manager has made some poor selections and performance has been negatively impacted.

Manager Departures

Fund manager departures can radically and negatively impact fund performance.

The role of a Discretionary Fund Manager

In essence and in very simplistic terms, the role of a discretionary fund manager (DFM) is to 'manage the managers' of an investment portfolio. A discretionary fund manager is also responsible for a number of tasks that include :

• Initial and ongoing research of funds and their managers

• Performing due diligence activities on the funds, the managers and the jurisdictions where they reside

• Creation of initial client portfolios

• Portfolio reporting

• Continuous portfolio analysis and re-alignment of funds and positions where required

If you are an existing investor think back and consider how you made your own initial investment decisions.

• What objective criteria did you have for your investments?

• What research did you employ?

• What risk evaluations did you perform?

• How did you apply selection criteria?

• What on-going monitoring, re-balancing and market assessments are now being applied?

In all probability you may not have had the time nor resources to carry out the above tasks due to a busy lifestyle. However in order to obtain the risk adjusted returns you seek, it is imperative that such a formulaic approach is adopted. Some investors would ask :

- Does a DFM really bring value to the investment portfolio? - after all, most of us have the ability to buy funds, stocks and shares without using a DFM.

- Can DFM charges be warranted?

We believe the answers to these questions are an emphatic YES for the vast majority of investors.

To learn more about the Discretionary Fund Management processes & procedures continue reading to gain further insight and discover how discretionary fund managers work to create value for investors.

If you would like to examine the details of how a TAM portfolio valuation provides detail and transparency please click here or contact us now to discover how a DFM service could improve your investment returns.

Discretionary Fund Manager processes

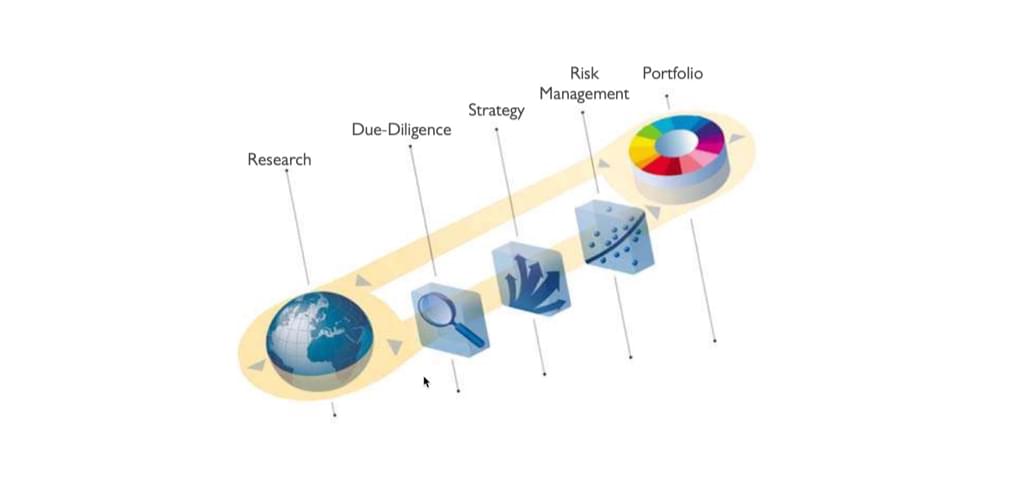

The 5 Fundamental Tasks

In respect of portfolio creation DFM's are responsible for:

• Research.

• Due Diligence.

• Strategy.

• Risk Management.

• Portfolio Construction.

5 Fundamental DFM Tasks

Fund research

Discretionary Fund Manager portfolios are diversified not only by underlying investment asset and sector, but also by manager and corporate provider. DFM managers believe this research discipline is an essential element in adding value to investment portfolios and risk diversification.

Creating “best of breed” multi-manager portfolios requires Discretionary Fund Managers to devote significant resource to fund research and due-diligence due to the universe of investment funds increasing daily. Numerous databases, sophisticated filters and screens to highlight funds that may be of interest to their investment teams are used exclusively throughout.

Analysts conduct peer-group analysis and other desk based research to produce targeted groups of funds that the Discretionary Fund Manager believe worthy of further investigation. To understand the strengths and weakness of any fund, a Discretionary Fund Manager will conduct face-to-face meetings with fund managers and their counterparts.

Additionally a Discretionary Fund Manager will conduct ongoing meetings throughout the year to ensure they are fully comfortable with any fund before it becomes worthy of the Discretionary Fund Managers panel.

Fund monitoring

All Discretionary Fund Manager funds are monitored on an ongoing basis and reviewed for consistency and style shift. Whilst there have always been a small number of “star” managers or funds which consistently perform regardless of current market environment these are unfortunately few in number.

The majority of funds will follow strategies tailored to certain sets of market conditions, whether though market sector or asset class. Understanding these synergies and anticipating which, how and when these funds will perform and equally are likely to under-perform are skills developed through many years of experience and implementation of the research process. Comprehensive fund research reports are continually and critically reviewed and updated.

Due Diligence

Factors that the research team will closely monitor in terms of a potential fund or fund manager include :

• Regulatory jurisdiction.

• Compliance..

• Liquidity.

The above checks and balances are required to be performed on each and every potential fund to be considered for a client portfolio and will additionally be performed routinely to ensure on-going compliance

Due Diligence Processes

Portfolio Construction Process

Construction

Value extraction is best achieved through medium to long-term strategic allocation to sectors and asset classes best poised to generate the risk/reward required over these periods. There are often occasions when a Discretionary Fund Manager will recognise increased risk or increased opportunity potential within the financial markets.

DFM's can and do make short and medium term tactical allocation decisions to ensure that portfolios remain responsive to prevailing market conditions. Often, rather than simply making marginal decisions, a DFM will make firm market calls and if necessary act decisively and alter portfolios to reflect the current investment environment

Portfolio Monitoring

A constant review process

Senior investment management personnel together with the Chief Investment Officer (CIO) meet regularly to direct and supervise the investment management teams who implement the day-to-day investment policy and strategy in pursuit of the investment goals.

Beyond that, investment management and research teams review economic data and market factors that impact ongoing portfolio risk and performance on a daily basis.

This consistent process allows managers to make tactical portfolio allocation changes swiftly and decisively should market conditions necessitate it.

Frequently asked questions (FAQ's)

We hope the above information has provided a clearer understanding as to why we as expat financial planning advisors see true value in Discretionary Fund Management and even more so in our preferred partners, TAM International and Momentum Global Investment Management (MGIM)

Please get in touch using the contact button below to discuss how a tailored investment solution will be designed to provide the returns you seek.