Site Search

Our site search facility enables you to look for content both within our main site and also our blog pages.

The first time a search is performed all pages are scraped for content which may take a few seconds to complete depending on your internet connectivity speed.

If you wish to search for a specific term or phrase please enable the 'ab' button within the search dialogue box

Trend Following InvestmentA mathematical approach to portfolio success

Understanding Trend Following: Beyond Traditional Investment Approaches

In the complex world of modern finance, where markets can shift from euphoria to panic within hours, traditional investment wisdom often falls short. Enter 'trend following' - a systematic investment methodology that has quietly generated substantial returns for sophisticated investors whilst providing crucial portfolio protection during market turbulence.

Unlike conventional approaches that attempt to predict market direction through fundamental analysis or economic forecasting, trend following operates on a deceptively simple premise: markets that are moving in one direction tend to continue moving in that direction. This mathematical approach to investing removes the guesswork, emotions, and cognitive biases that plague traditional investment decisions.

Key Insight: Trend following strategies don't predict where markets will go they systematically identify and exploit existing market momentum across multiple asset classes, adapting to changing market conditions in real-time.

The foundation of trend following lies in its mathematical rigour. Rather than relying on subjective market opinions or economic predictions, these strategies employ quantitative models that analyse price movements, volatility patterns, and momentum indicators across diverse markets including commodities, currencies, bonds, and equity indices.

The Mathematical Foundation: Why Numbers Trump Emotions

Traditional portfolio construction typically involves static allocations between equities and bonds, adjusted periodically based on market outlook and risk tolerance. Whilst this approach has served investors for decades, it contains inherent limitations that systematic trend following can address.

Elimination of

Emotional Bias

Human investors consistently fall prey to cognitive biases such as recency bias, loss aversion, and confirmation bias. Mathematical trend following systems eliminate these psychological pitfalls by adhering to predefined parameters.

Precise Risk

Management

Trend following systems incorporate volatility-adjusted position sizing, allocating larger positions to less volatile instruments and smaller positions to more volatile ones. This mathematical approach delivers more consistent risk-adjusted returns.

Rigorous

Backtesting

Mathematical models can be tested across different market environments using historical data, providing evidence-based confidence in strategy robustness compared to traditional models.

Multi-Timeframe

Analysis

Trend following strategies combine signals from multiple timeframes and technical indicators, creating a comprehensive market view that captures profits across different cyclical phases.

The mathematical edge becomes particularly evident during periods of market stress. March 2024 marked a transformative moment for trend following, culminating a four-year period of robust performance initiated in 2020, demonstrating the strategy's ability to adapt to changing market regimes.

Crisis Alpha: The Ultimate Portfolio Insurance

Perhaps the most compelling characteristic of trend following strategies is their ability to generate what industry professionals term "crisis alpha" - positive returns during periods when traditional investments are experiencing significant losses.

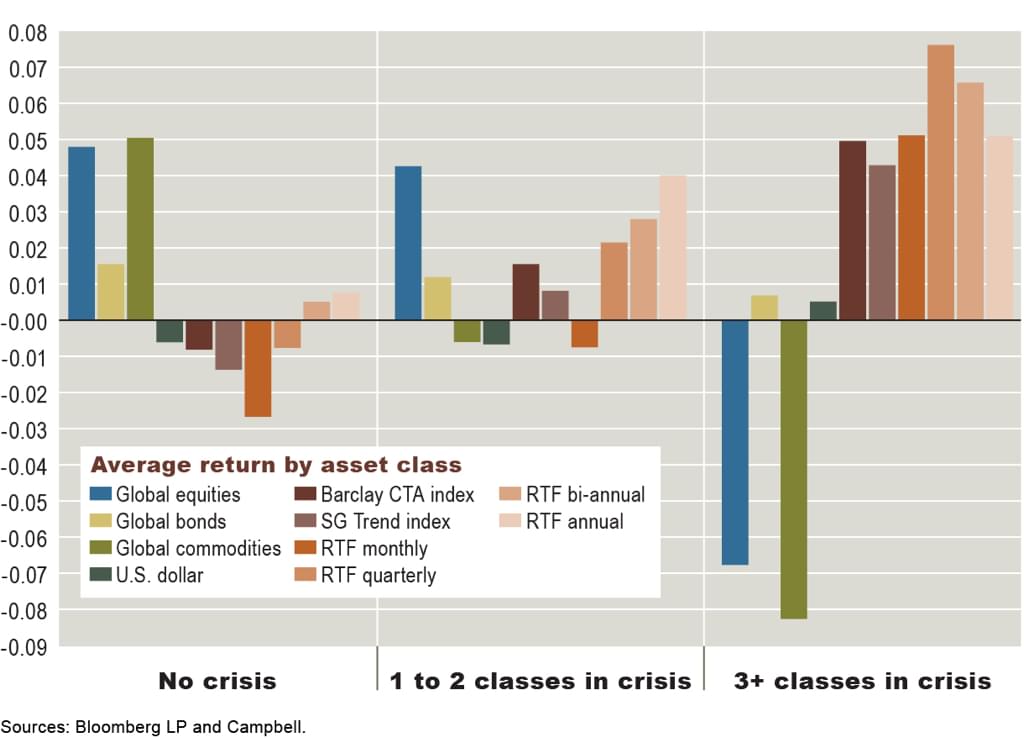

Average quarterly returns when no assets classes are in crisis, 1 to 2 are in crisis, and 3+ are in crisis for global equities (MSCI World Total Return index); global bonds (Barclay Global Aggregate Bond index); global commodities (S&P GSCI Total Return index); U.S. dollar (USD index); CTAs (Barclay CTA index and SG Trend index); and trend following (RTF monthly, quarterly, bi-annual and annual). For each individual index a crisis is defined as the worst ten quarterly returns. Data are for Q1 2000 through Q4 2016.

During crisis periods, diversified CTA portfolios can deliver annualised returns between 20% and 30%, providing crucial portfolio protection precisely when investors need it most. This performance characteristic stems from trend following's ability to profit from prolonged market movements in any direction - including sustained downtrends.

Trend-followers are more likely to deliver negative crisis betas during crises lasting over extended periods, as most trend-following CTAs apply medium-to long-term time horizons for signal generation. This negative correlation during market downturns makes trend following an invaluable portfolio diversifier.

Sources: Pensions & Investments CTA Crisis Alpha Commentary, The Hedge Fund Journal Trend-Following Analysis

Strategic Asset Class Focus: Quality Over Quantity

Whilst trend following can theoretically be applied to any liquid market, successful implementation requires strategic focus. Rather than attempting to trade every available instrument, effective trend following strategies concentrate on select asset classes that exhibit strong trending characteristics.

Optimal Market Selection Criteria

The most effective trend following strategies focus on markets with specific characteristics: sufficient liquidity for efficient execution, clear regulatory frameworks, and most importantly, strong historical trending behaviour. Commodities and currencies often display clearer and more sustained trends than individual equities, making them prime candidates for trend following strategies.

Portfolio Diversification Through Asset Class Selection: A carefully curated selection of energies, metals, agricultural commodities, currencies, and fixed income instruments often provides superior diversification compared to broader selections with similar market drivers..

Well-known managers in the trend following space include Winton, Transtrend, Fort, Quantica Capital and others who typically use systematic methodologies to discover patterns and momentum across multiple sectors of the commodity and financial futures space.

This focused approach offers several advantages: deeper market specialisation, reduced operational complexity, improved trending behaviour capture, and enhanced portfolio correlation management. By concentrating on markets with distinct fundamental drivers, trend following strategies can achieve true diversification whilst maintaining operational efficiency.

Complementing Traditional Portfolios: Integration, Not Replacement

The most common misconception about trend following is that it should replace traditional equity and bond allocations. In reality, trend following serves as a powerful complement to conventional portfolios, enhancing overall risk-adjusted returns whilst providing crucial downside protection.

The 60/40 Portfolio Enhancement

Consider a traditional 60% equity, 40% bond portfolio, the bedrock of institutional investing for decades. Whilst this allocation has historically provided reasonable returns, it faces significant challenges in current market environments: low bond yields, elevated equity valuations, and increased correlation between stocks and bonds during stress periods.

Integrating trend following into this framework - perhaps as a 10-20% allocation can transform portfolio characteristics:

Enhanced

Diversification

Trend following provides exposure to assets rarely found in 60/40 portfolios, thus maintaining low correlation to such portfolios.

Protection On

The Downside

During equity bear markets, trend following strategies can shift to short positions or move to cash, providing portfolio protection.

A Hedge Against

Inflation

Through commodity exposure, trend following strategies can provide inflation protection that traditional equity and bond portfolios often lack.

A Reduction

In Volatility

Low correlation characteristics of trend following can reduce overall portfolio volatility whilst maintaining or enhancing expected returns.

Practical Implementation Considerations

Successful integration requires careful consideration of allocation sizing, rebalancing frequency, and manager selection. In 2022, 27 out of 30 individual CTA programs delivered positive performance, with trend-followers showing returns ranging from 11% to 40%, demonstrating both the strategy's effectiveness and the importance of proper implementation.

Important Consideration: Trend following strategies exhibit their own performance cycles, sometimes experiencing multi-year periods of underwhelming returns. This cyclicality requires patience and understanding from investors, making proper education and expectation setting crucial for successful implementation.

Understanding the Challenges: Realistic Expectations

Despite its advantages, trend following is not without limitations. Understanding these challenges is crucial for setting appropriate expectations and ensuring successful long-term implementation.

The Whipsaw Challenge

Trend following strategies typically struggle during choppy, range-bound markets characterised by frequent reversals. These "whipsaw" conditions can lead to multiple false signals and consecutive small losses, testing investor patience and conviction.

Recent performance data illustrates this challenge: TTU Trend Following Programs experienced declines in May 2024 (-1.26%) and maintained a slight loss for the year (-2.59% through September), demonstrating the strategy's cyclical nature and the importance of long-term perspective.

Psychological Implementation Challenges

Whilst mathematically sound, trend following can be psychologically challenging to implement. Extended drawdown periods and long stretches without new equity highs can test even disciplined investors' patience. The systematic lag inherent in trend following - capturing the middle portion of trends whilst missing turning points - means giving back some profits at trend reversals.

Capacity and Scalability Considerations

As assets under management grow, some market niches become too small relative to position sizes, potentially reducing the universe of tradable markets and diminishing returns. This capacity constraint requires careful consideration when selecting managers and allocation sizes for this reason you should contact us to discuss your circumstances.

Current Market Environment and Future Outlook

The investment landscape continues to evolve, with traditional portfolio construction facing unprecedented challenges. Central bank intervention, elevated asset valuations, and increased market volatility have created an environment where alternative strategies like trend following become increasingly valuable.

Recent market conditions have highlighted the importance of diversification beyond traditional equity and bond allocations. The simultaneous decline in both stocks and bonds during 2022, breaking decades of negative correlation, demonstrated the vulnerability of traditional 60/40 portfolios and the value of truly uncorrelated strategies.

Learning from Trend Following Professionals

Read and listen to key podcast and journals that provide invaluable insights from trend following professionals about their backgrounds, how they operate, their methodologies and why they are so passionate about the trend following investment style.

Hedge Fund Journal

'Tomorrows Titans'

A spotlight on Gareth Abbot and his journey in to the world of trend following investment. A former Oxford university mathematician and now the CIO of a leading trend following investment fund.

The 'Rising Stars & Trend Titans" is a lens into the dynamic trend following space.

The article spotlights standout performers across the spectrum of globally diversified, rules-based trend-following programs.

Michael Covel of 'Trend Following' book fame interviews Gareth Abbott in a very illuminating podcast.

A "Top Traders" podcast providing further insight into the operations and success of the Global Alpha Fund

An insightful trend following podcast with Aspect Capital Founder, Martin Lueck. (Martin Lueck being the 'L' in Man 'AHL')

Looking Forward: As markets become increasingly complex and interconnected, the mathematical rigour and adaptive nature of trend following strategies position them as essential components of modern portfolio construction, providing both return enhancement and crucial risk management capabilities.

The integration of technology and quantitative methods in investment management continues to accelerate, making sophisticated trend following strategies more accessible to a broader range of investors whilst maintaining the core principles that have driven success for decades.