What is the value of remaining invested?

Filed in: Investment |Momentum |TAM

03 March 2018

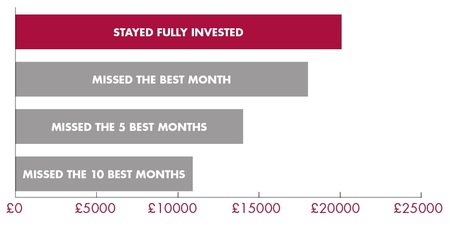

Intrinsic carried out a useful statistical comparison that delivered clear results. The comparison took data from investors using Intrinsic’s most popular diversified fund over a period that included significant market fluctuations and negative media coverage. It shows the returns for investors who stayed invested throughout compared to the returns for investors who felt they should sell and missed out on the best month, five best months and ten best months.

The results

The results, showing the collective value of investments

Graphical explanation

This bar chart clearly illustrates that the risk of losing profits if you try to second-guess the market by buying and selling rather than remaining invested.

Time in the market, not timing the market

The rationale here is that if you try to time the market and get it wrong you would be signicantly worse off than if you stayed invested for the duration.

Seeking professional advice significantly improves your chances of remaining invested and enjoying the rewards – many of our clients have benefitted from using our recommended Discretionary Fund Managers to achive the rewards of remaining invested.

Please contact us if you would like to discuss discretionary fund management